Overview

Better than expected news on inflation and growth, released during the second part of July, contributed to particularly tonic equity performances worldwide this past month.

In July, the S&P’s 500 rose 3.21%. The Nasdaq Composite added 4.08%. Finally, the Russell 2000 (Small Cap Stocks.) jumped 6.12%. The general “risk-on” mood caused the USD to drop a little over 1% against a basket of major currencies. That helped the EPAC BM Index of developed economies (ex-US) rise 3.52% and the MSCI EM (Emerging markets) add 5.80%.

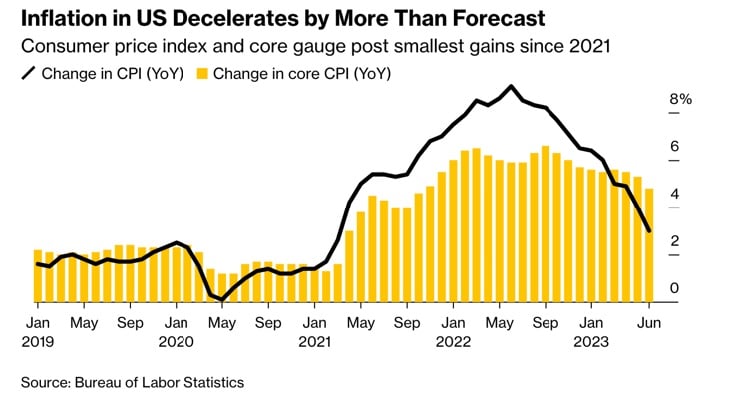

The trigger for these spectacular performances was the release, on July 12, of unexpectedly positive news on US inflation, as shown in the chart below:

US inflation hit a 2-year low of 2.97% (black line) in June, on a year-over-year (YOY) basis. The CPI dropped to that level from a 4.05% reading the prior month. The Core CPI, a measure of inflation that the FED pays particular attention to, dropped from 5.33% to 4.83% (yellow bars). While less spectacular, this decline confirmed the overall trend and led investors to think that the FED would probably not maintain its tight grip on interest rates much longer, causing equities to rise.

In this environment, US bonds were generally stable with the US bond aggregate index down only .07%. while corporate bonds added from .31% for the Bloomberg Corporate Index to 1.38% for its High Yield counterpart.

In July, our median portfolio grew 2.40%. Over the same period, a portfolio consisting of 50% ACWI (All Country World Index) and 50% AGG (US Bond Aggregate) rose 1.79%. YTD, our median account is up 10.53% vs. 10.27% for our reference index.

Market developments

July started with a positive employment report. While the unemployment rate dropped to 3.6%, the job gains at 209,000 for the month, were below expectations and wage moderated somewhat to reach 4.35% (YOY). These numbers were interpreted as indicative of a resilient US economy.

This positive picture was further enhanced by the rosy inflation numbers mentioned earlier and, in combination, caused the market to rally throughout the end of July.

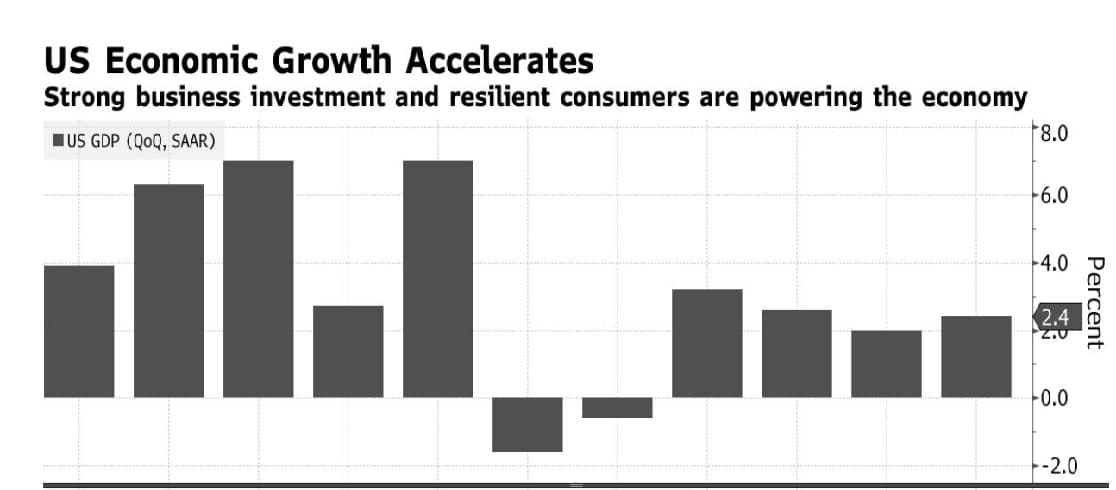

At the end of the month, good GDP numbers for the second quarter (see chart below), came in at 2.4% and above expectations, further affirming the positive mood.

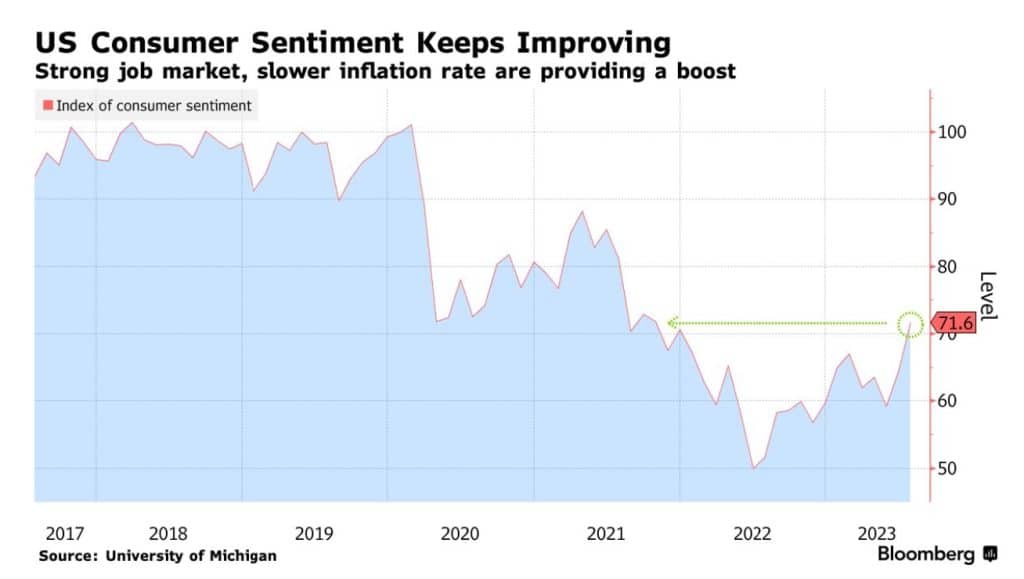

Finally, and topping it all, the end of the month came with the releasee of improving consumer confidence numbers. The US consumer feels better about the US economy and its future, as shown in the chart below:

The US economy appears to be humming despite the restrictive monetary policy conducted by the FED. Inflation is dropping and the employment picture remains good. In that context, the FED will find it increasingly hard to justify tightening interest rates much longer.

Tilts and Allocations

In July, I did not change our general asset allocation. Most of my trading activity was limited to rolling (replacing) maturing US Treasury bills. With yields hovering between 5.40% and 5.50%, for three and six months government bills, I kept as little cash as possible uninvested.

Elsewhere in our portfolio, Schwab jumped 16% after announcing quarterly results that were not as bad as anticipated. If you recall, the bank crisis of this past March caused their stock to tank close to 40% (from top to bottom). I took this development as an opportunity to invest. Most clients’ portfolios are invested in SCHW.

The above chart illustrates the performance of SCHW since we bought, at the end of March, around $53 on average. The vertical line marks the second quarter earnings announcement and the subsequent price jump. I expect the share to continue to rise over the coming months and eventually reach their pre-crisis level of $85. This will happen all the more rapidly as the FED stops hiking interest rates and/or Schwab announces a return to pre-crisis profitability (which they will reach, eventually, given their impeccable record in that respect).

Finally, a note on oil prices: they jumped 14% in July. This means that the next CPI number, released in mid-August, is unlikely to go down much. Hopefully, the Core CPI (ex-energy and food) will confirm the downward trend established since June. Should that be the case, the negative market momentum since the beginning of August might stop.

Conclusion

We have now entered a seasonally difficult period for equities. August and September often inflict losses on equity portfolios. With uncertainty still surrounding FED policy, low liquidity and other seasonal effects, the coming weeks may not be pleasant for investors.

Let’s remain optimistic though. The US economy has shown incredible resilience, employment is softening but still robust and inflation is dropping.

A good series of inflation number in August could deter the FED from an additional/final interest rate hike at the end of September. I certainly hope so.

Thank you for your continued trust.

Jeff de Valdivia, CFA, CFP

Fleurus Investment Advisory, LLC

www.fleurus-ia.com

(203) 919-4980