Overview

Equities and bonds continued to rally in December, gaining further momentum after the FED’s “pivot” of early November.

The S&P’s 500 rose 4.54%. The Nasdaq Composite was up 5.58% and the Russell 2000 (Small Cap Stocks.) blasted 12.22% up. In international markets, the EPAC BM Index of developed economies (ex-US) rose 5.56% and the MSCI EM (emerging markets) 3.71%.

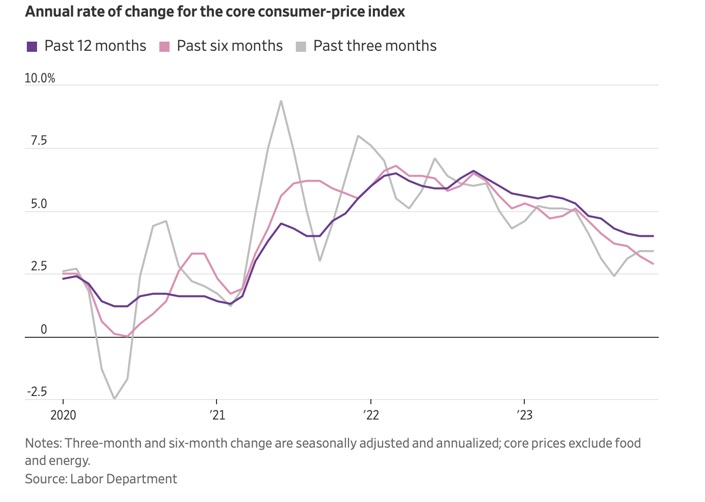

Continued good news on the inflation front, illustrated below, contributed to the spectacular market performance:

As of the end of November, the US CPI had declined to an annual rate of 3.1%. The Core CPI remained slightly higher at 4.0% overall. However, the declining trend seemed to be accelerating and the probability that the FED will be compelled to cut interest rates sooner than expected is increasing.

The good news was not confined to equites. In fixed income, the US Aggregate rose 3.83%, the Bloomberg Corporate bond index was up 4.34% and the municipal sector rose 2.32%.

In December, our median portfolio rose 4.45%. Over the same period, a portfolio consisting of 50% ACWI (All Country World Index) and 50% AGG (US Bond Aggregate) rose 4.26%. In 2023, our median account was up 15.05% vs. 13.98% for our benchmark.

Market developments

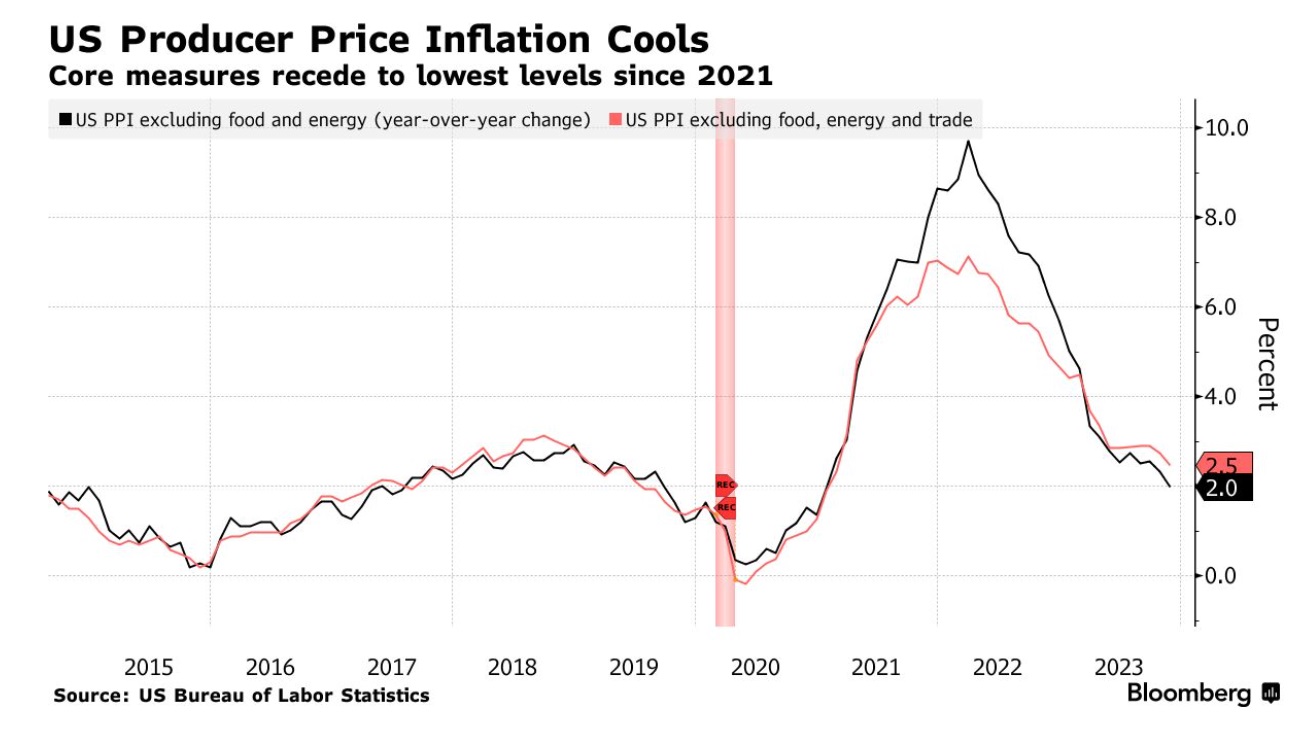

The positive Consumer Price Index data released in the middle of December was further confirmed, shortly thereafter, by other inflation-related news, as illustrated below:

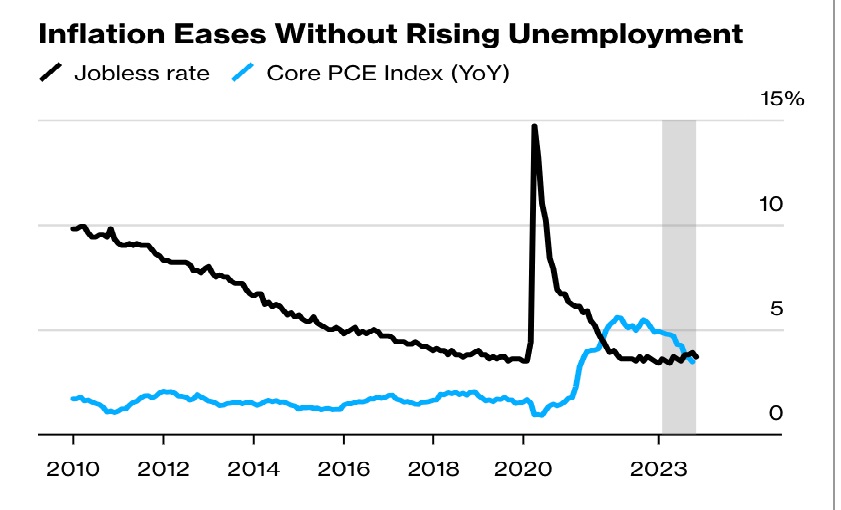

All this happened in an economic environment that continues to support a high level of employment. In other words, the tight monetary policy of the FED has not, so far, resulted in a rising unemployment rate, as illustrated below:

This is good news for the US consumer. A consumer who has a job tends to buy “stuff”. Since that consumer is responsible for 70% of the US GDP, the sturdy employment picture augurs well for 2024.

So far, the FED’s tight monetary policy has not pushed the US economy into a recession. However, this state of affair cannot last much longer. The FED cannot keep its intervention rate at 5% if inflation trends at a 2% annual rate. If the trend is confirmed in January, I would not be surprised if the FED decided to reduce interest rates as early as February.

Portfolio Commentary

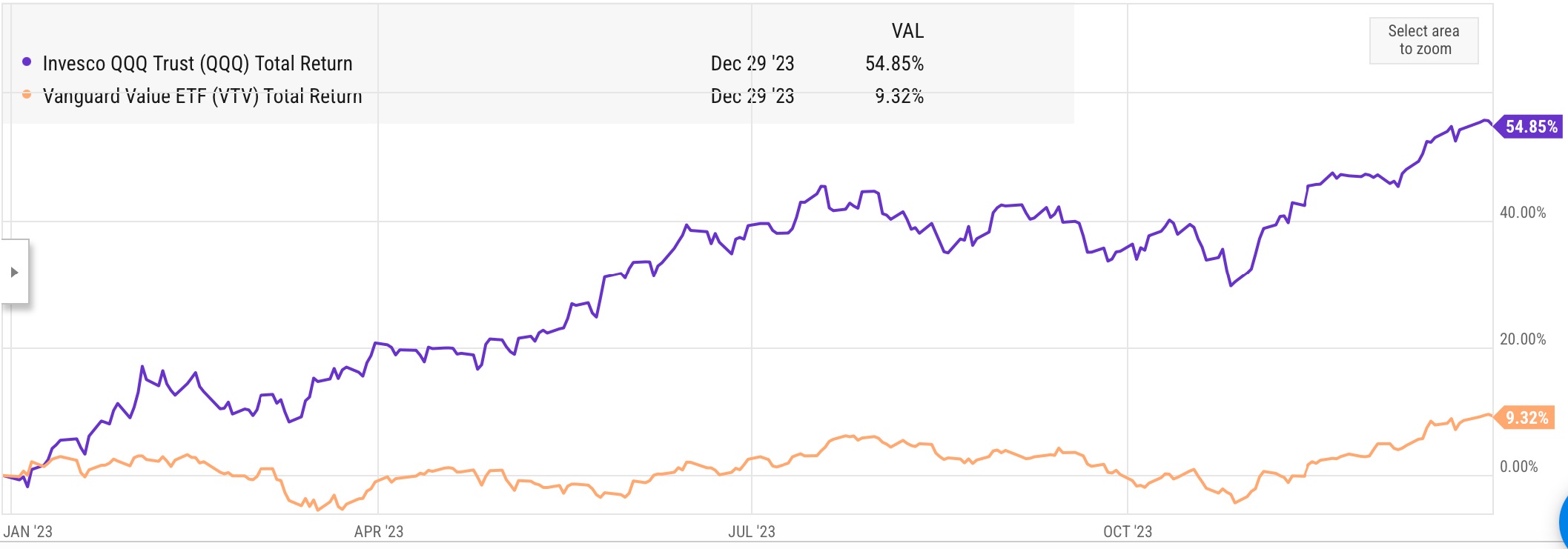

In December, I started reducing our investment in QQQ, the Nasdaq/Tech-ladened ETF, by about 10% to 15%, across all accounts. I invested the proceeds into VTV, the Value ETF.

The graph below illustrates the performance of QQQ and VTV in 2023.

In March 2023, I started a position in QQQ. This ETF has gained about 40% since then. Meanwhile, VTV has lagged considerably, generating a meager 9% over the same period.

This performance gap is not likely to continue when the FED loosens its monetary stance, as is expected in 2024. When that happens, those sectors of the stock markets that have not pushed significantly higher yet are finally likely to get their day in the sun; in particular, high dividend-paying stocks, such as those of the pharmaceutical and defense sectors, the laggards of 2023. Hence my decision to increase our investment in VTV and to reduce QQQ in the same measure.

Elsewhere in our portfolios, I continued to increase our exposure to AGG, the US bond aggregate. As our investments in US Treasury bills mature, I will invest in AGG in order to profit more from the improving interest rate environment.

Conclusion

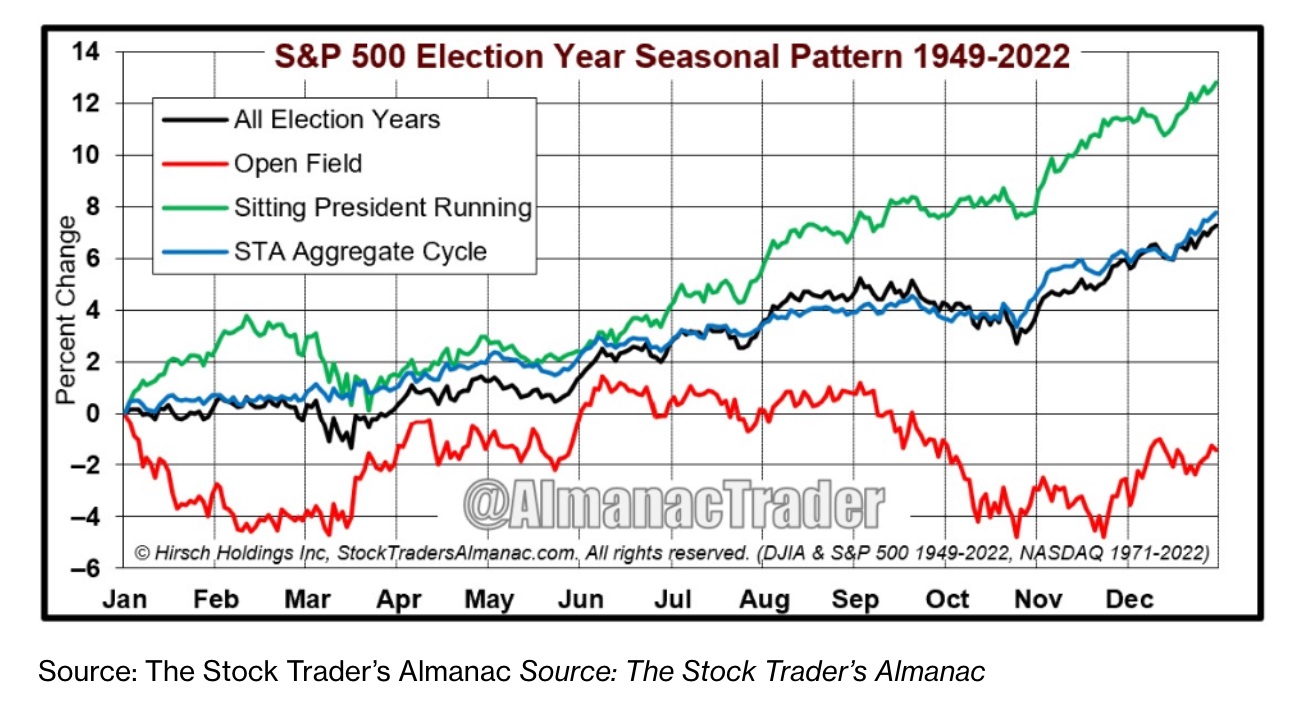

For those of you who worry that the recent US market performance will not last, here is a graph that may offer solace:

For now, I see no tangible reason to reduce our risk posture.

Thank you for your continued trust.

Jeff de Valdivia, CFA, CFP

Fleurus Investment Advisory, LLC

www.fleurus-ia.com

(203) 919-4980