Overview

Mixed and confused! In April, that is how US equity markets behaved.

The S&P’s 500 rose 1.56%, the Nasdaq Composite squeezed a meager .07% gain while the Russell 2000 (Small Cap Stocks.) dropped 1.80%. The USD dropped .90% against a basket of key currencies. The weakening USD helped the EPAC BM Index of developed economies (Ex-US) rise 2.05%. On the other hand, emerging markets were down 1.13% (MSCI EM).

A general drop in commodity prices explains their relatively poor performance.

The US bond market rose overall. The US long bond rose .52% and, across the high yield corporate as well as the municipal sectors, performances were neutral to positive.

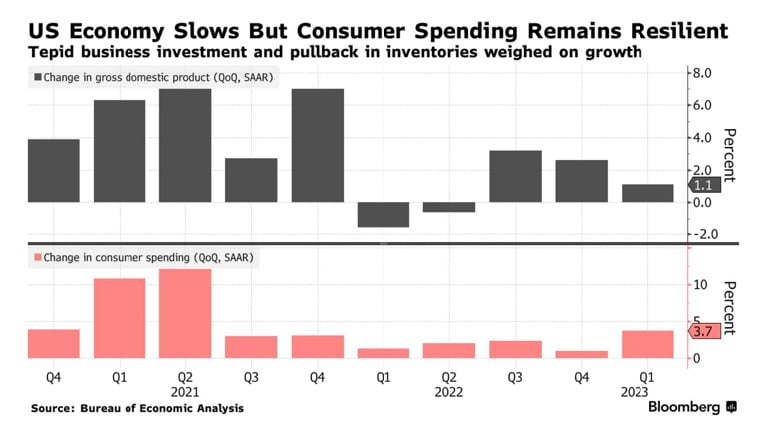

Part of the confusion and lack of market direction comes from the contradiction illustrated in the chart below:

The US economy is clearly starting to slow down under the Federal Reserve Banks’ (FED) restrictive monetary policy. However, The US consumer does not yet seem to significantly rein in her spending, confusing investors as to the duration of the FED’s current policy and its chances of reducing inflation quickly.

In April, our median portfolio gained 1.03%. Over the same period, a portfolio consisting of 50% ACWI (All Country World Index) and 50% AGG (US Bond Aggregate) rose 1.07%. YTD, our median account is up 4.34% vs. 6.45% for our reference index.

Market developments

The month of April started with relatively good unemployment numbers for the month of March.

The US economy created “only” 145,000 jobs in March and in doing so surprised positively market participants. In a confusing way for most observers, in the current environment, a slow-down in hiring is “good” because it increases the chance of success for the FED in its fight against inflation. The fewer the number of people employed the lesser the wage pressures in the system and the greater the chance of inflation being contained.

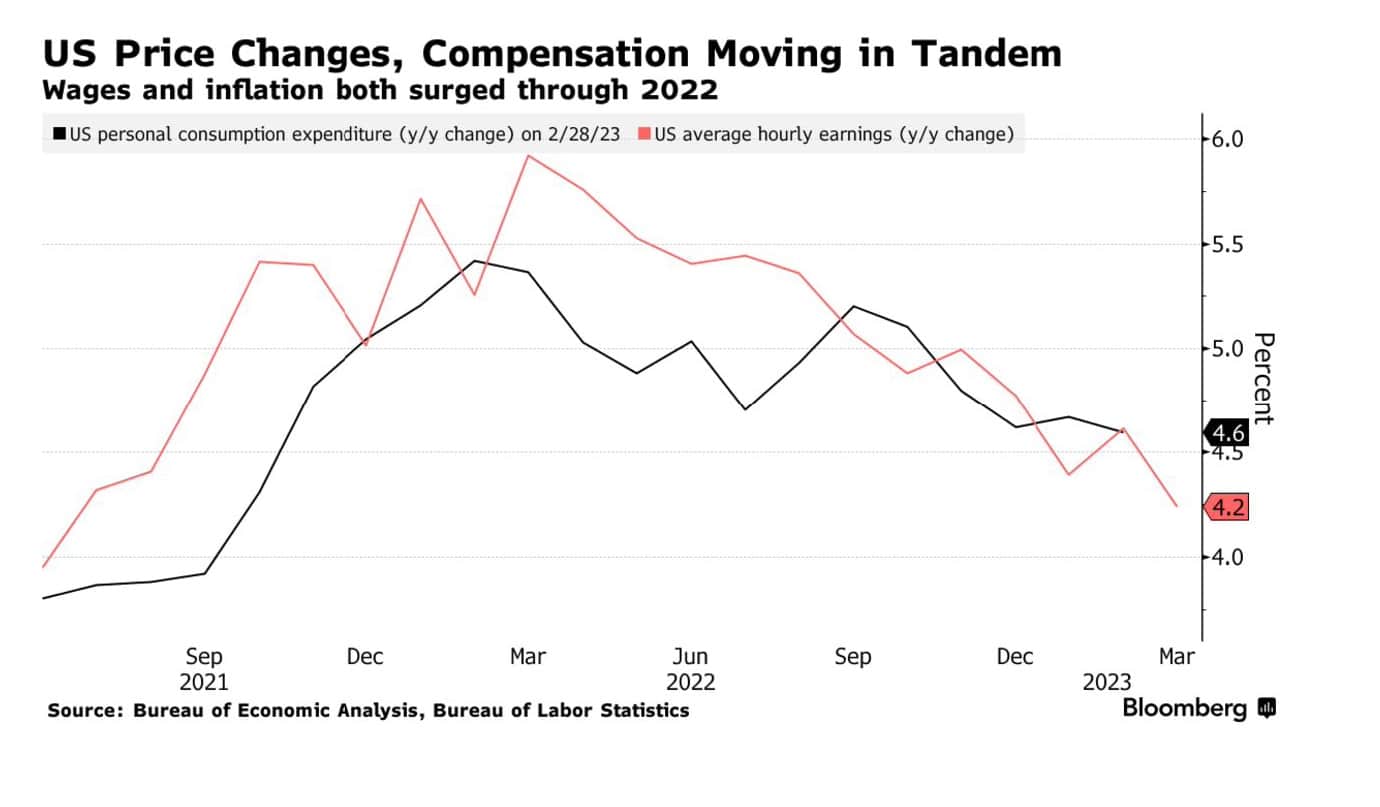

The link between wages and inflation is illustrated below:

As the rate of growth of average earnings (red line) drops, so does the rate of growth of prices (black line). This relationship is what is informing the FED’s policy and explains why a rise in unemployment is typically associated with a reduction of the rate of inflation.

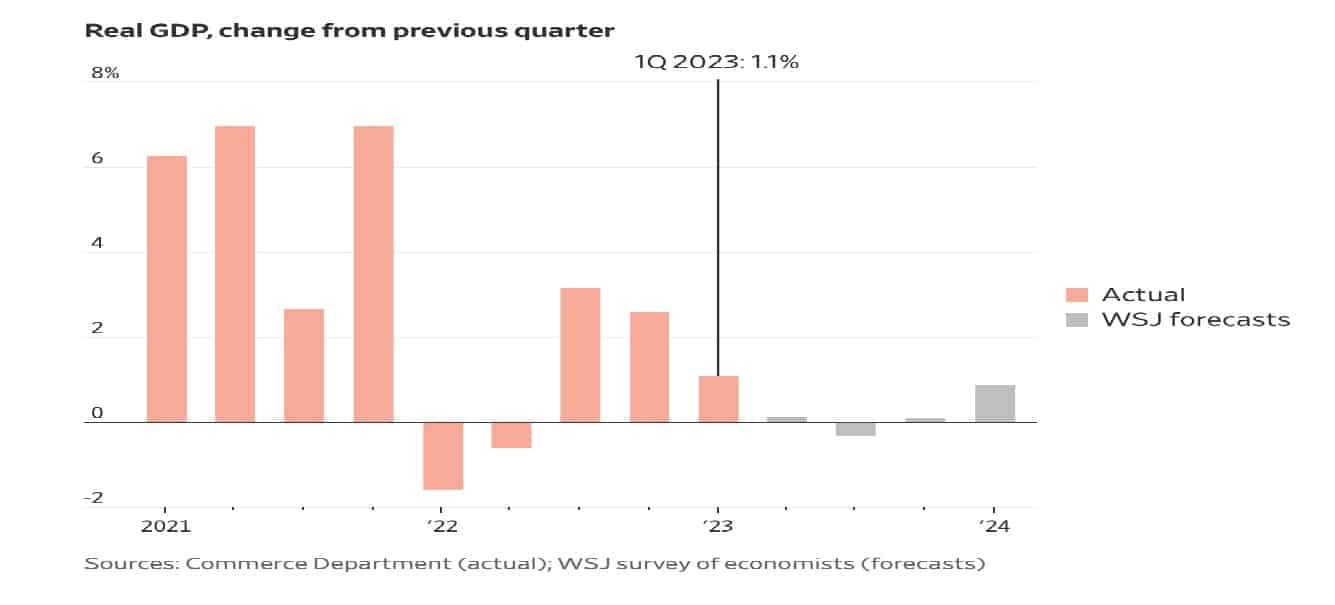

Based on the chart below, the economic slowdown that the FED has engineered is working.

Whether it causes lasting damage to employment in the process remains to be seen.

Tilts and Allocations

Market volatility remained high in April. General economic uncertainty, confusion about the health of the US banking system and contradictory signals coming from the US economy all contributed to this state of affairs.

In April, I took time to simplify our investments. Specifically, I reduced the number of positions that we have in each broad asset category. I did not change our overall risk levels.

Our fixed income investments are now limited to short-term US Treasury bills (that yield around 5%) and AGG, the US bond aggregate ETF .

Similarly, in equity-land, our international exposure is limited to IEFA, the ETF that tracks the performance of developed economies (ex-US A). Outside of IEFA, we are invested in Air Liquide. The French industrial gas company. It is a long-term investment that has done well for us lately. It is up about 40% since its October low.

Our allocation to US equities has been similarly reduced to a few key ETFs investments. I will not depart from this broad and concentrated approach going forward unless market conditions make an investment in a specific sector/company very appealing. This is what happened last month with the turmoil in the US banking sector. I decided to take a position in SCHW (Charles Schwab). I have been involved with this company for close to forty years, first as an individual investor and for the past ten years as a professional money manager. I know how they operate. I know how disciplined and efficient they are. I am confident that this is a good investment, even if currently it is costing us money. As the turmoil in the US banking sector subsides, SCHW should bounce up nicely for us.

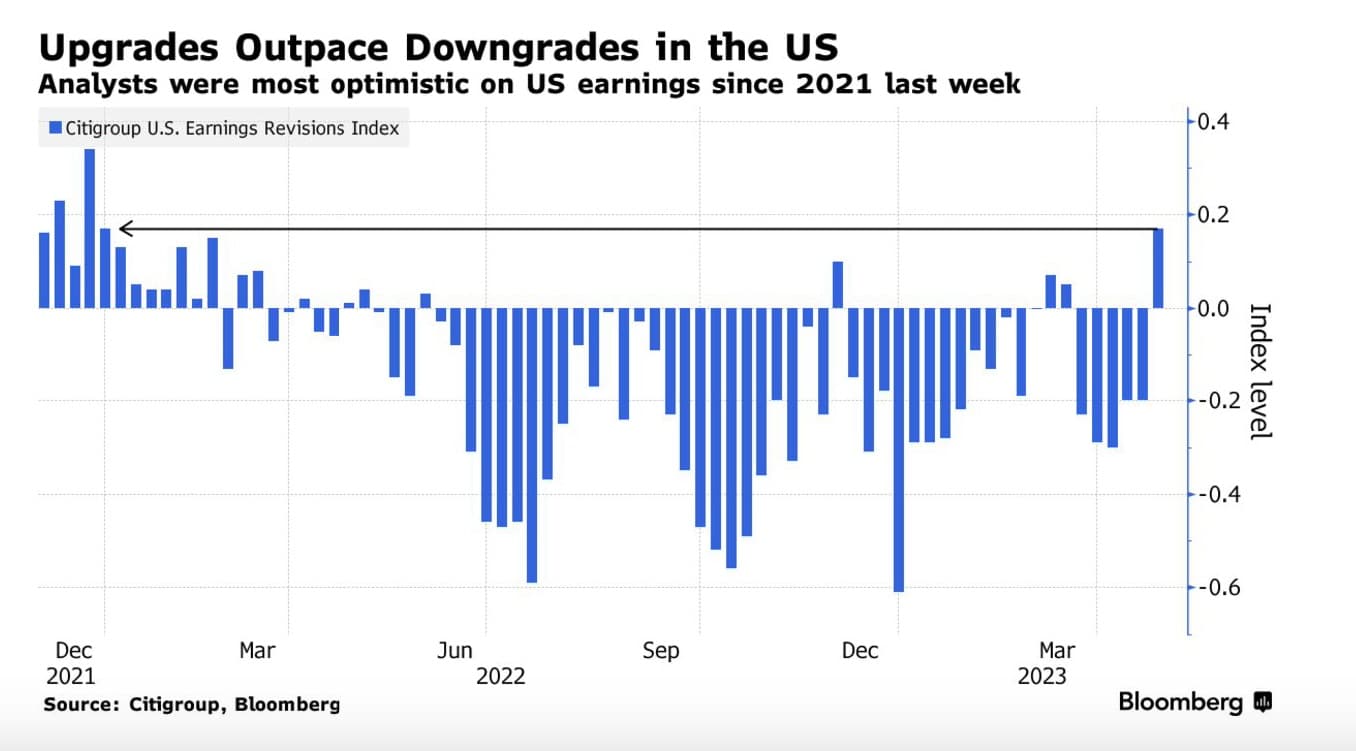

I will conclude this note on an optimistic piece of information. Below is a chart that tracks corporate earnings, the main engine behind stock performance. Focus on the last piece of data to the right of that chart. The situation is still positive!

Conclusion

As I write this letter, the market is shaken by another bout of anxiety over the health of the US banking system and particularly of US regional banks.

The FED’s restrictive policy has damaged many banks’ assets. As interest rates rise, the value of their bond holdings depreciates. In and of itself, this is not a cause for concern. Unless your depositors start taking their money and run ….

If and when that happens, as was the case with SVB, Signature bank and more recently First Republic Bank, the bank has to sell its bonds at a loss to meet its liquidity needs. The losses generated in the process may amount to levels that make their viability questionable for lack of capital (bank reserves). When investors start seeing this development as a credible scenario, the stock of the bank drops down and can be engulfed in a death spiral. Eventually, regulators intervene, induce larger banks to take the smaller ones to stabilize market and…things quiet down.

With the FED signaling yesterday that they were likely done with interest rate hikes, I hope that the pressure on banks will now lessen and that the current turmoil will dissipate. If it persists, the FED, together with poor risk management at the afflicted banks, will have engineered a recession.

Inflation will be vanquished, but at a hefty price for all of us.

Please feel free to reach out to me with any questions. Thank you for your continued trust.

Jeff de Valdivia, CFA, CFP

Fleurus Investment Advisory, LLC

www.fleurus-ia.com

(203) 919-4980