Overview

This past month, a surprisingly robust US economy coupled to stronger than expected inflation data combined to spook markets.

In April, the S&P’s 500 declined 4.08% while the Nasdaq Composite lost 4.38%. The Russell 2000 (Small Cap Stocks) suffered more, declining 7.04%. In international markets, the EPAC BM Index of developed economies (ex-US) lost 3.13%. The MSCI EM (emerging markets) gained .53%, as it benefitted from the support of commodity prices.

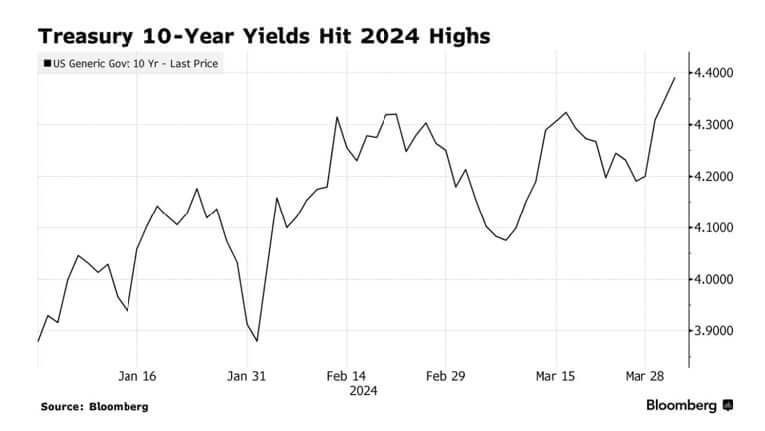

Strong economic numbers, at the beginning of the month of April, going from a US unemployment number going down to 3.8%, unexpectedly strong US monthly payrolls (+300K in March), US manufacturing showing its first expansion since September 2022 coupled to a continued uptick in inflation numbers combined to scare bond investors. With rates higher and the prospect of the Federal Reserve (FED) not loosening monetary policy until much later in the year, both bond and equity investors reduced their overall risk levels. The graph of the US Treasury ten-year yield below reflects this deterioration:

In a development reminiscent of the dreadful 2022, both fixed income markets and equities were sharply down in April. The AGG index was down 2.53% while Investment Grade and High Yield corporate bonds dropped respectively 2.54% and .94%.

In April, our median portfolio lost 3.11%. Over the same period, a portfolio consisting of 50% ACWI (All Country World Index) and 50% AGG (US Bond Aggregate) lost 3.02%. YTD our median portfolio, net of fees, is up 1.90% vs .59% for our reference index.

Market developments

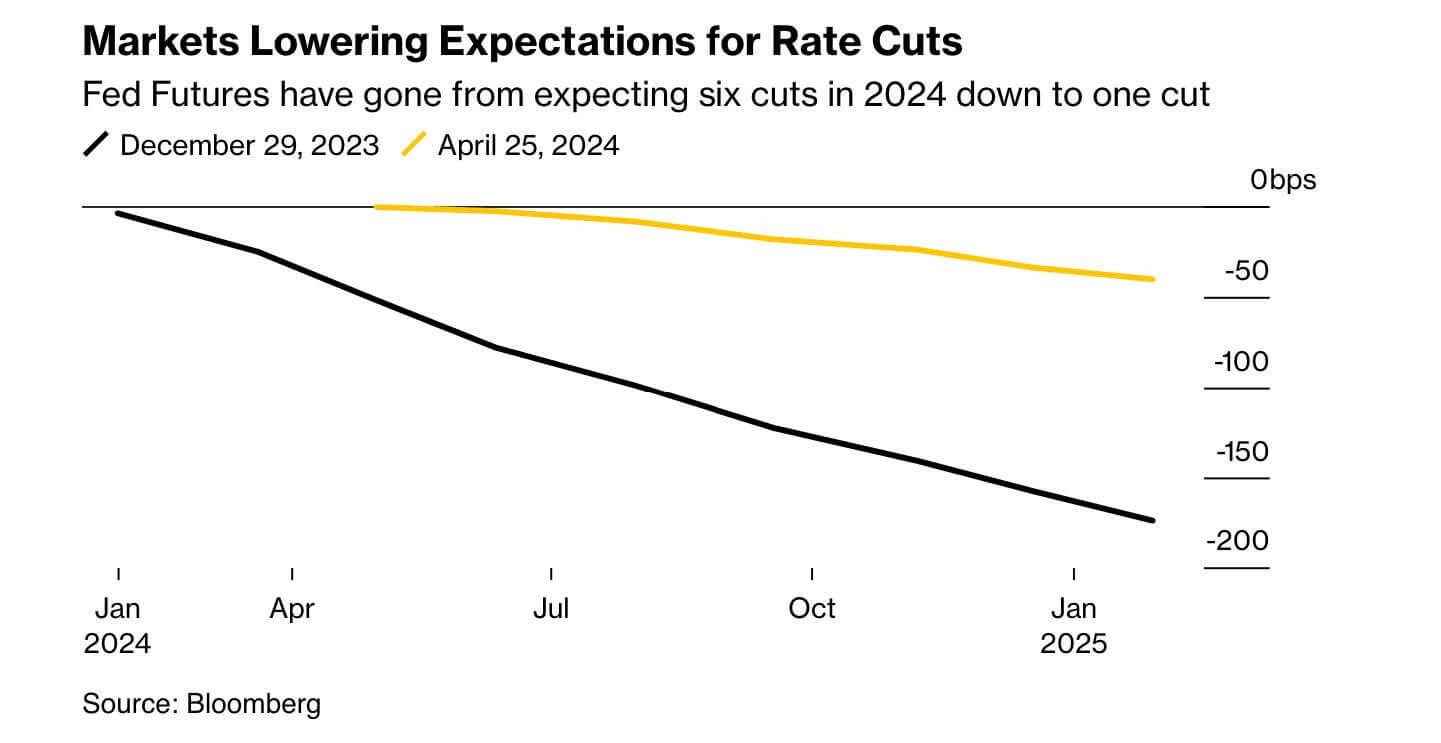

Perhaps the graph that summarizes the best the change of market mood and that explains both the bond and equity market price actions this past month is the one below:

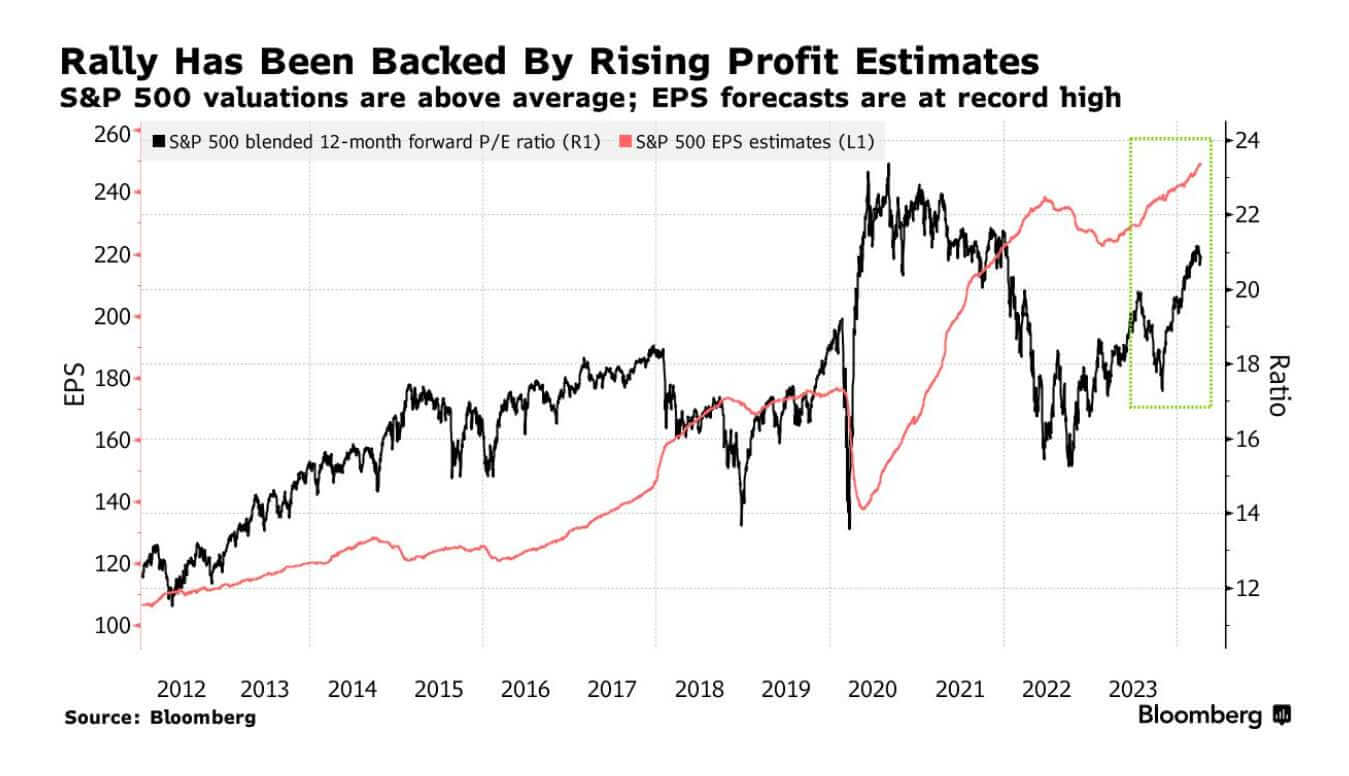

Adjusting portfolios to such a drastic change in interest rate expectations is bound to generate some havoc. The bond investor who expected interest rate cuts in 2024 (I would venture to say that this represents about 99% of investors in January) would have, as a result, extended the duration of their portfolio. In doing so they would show losses as of today, all the more as the average duration of their portfolios has been extended. As for equity investors, the rising yields translate into higher discount rates for future cash flows and mechanically, lower valuations, all things equal otherwise. Hence the drop in equity prices in April. However, for equity investors, corporate earnings matter and can save the day. And that is where the current market drawdown may find its support. Corporate earnings for first quarter of 2024 have been generally good. It is hard to take equities down when corporate earnings are growing at a 9% to 10% clip. The graph below shows the earnings turn-around that will make a significant market correction unlikely, absent other pressures:

Portfolio Commentary

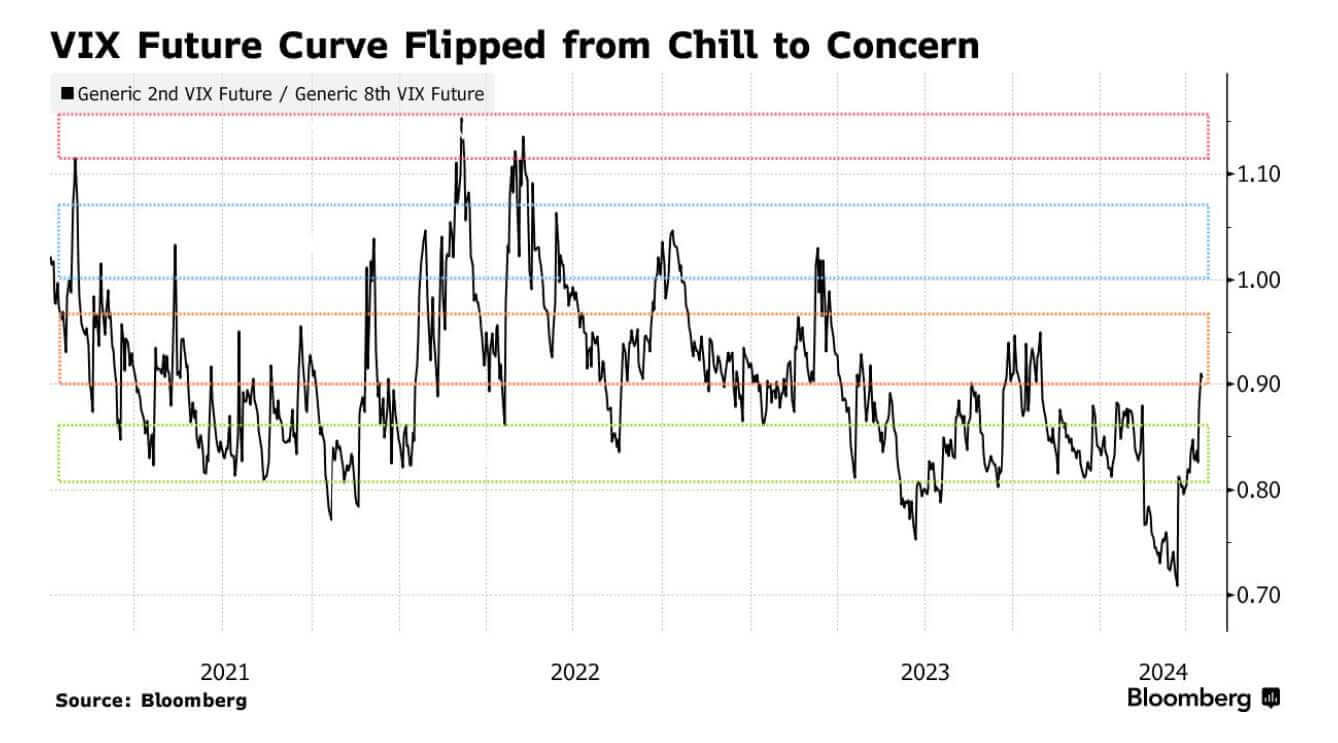

The corollary to a confusing or unstable economic environment is often heightened market volatility. The graph of the VIX index below shows how much the recent uncertainty around the overall level of interest rates affected markets:

The sharp move up at the right of the graph reflects the increasing market concerns in April.

In this environment, and perhaps counterintuitively, I reduced some of our gold exposure. Gold is often viewed as a haven investment. However, in the past 40 years it has rarely worked as such. I thought that after the nice price run-up that it has enjoyed over the past six months, it was time was to take some profit and I did. Below is a chart of IAU one of the ETFs in that sector.

The vertical line marks the height of the covid period and the previous high price for IAU before vaccines were found. We have surpassed those levels in the past six months. I would not be surprised if, other than for geopolitical concerns growing again, the bulk of the gains in gold are in the past

Conclusion

As I write these lines, the US equity markets have recouped some of their April losses. Yesterday, the unemployment rate ticked up to 3.9% from 3.8% and its wage component has grown less than expected which is viewed as positive in the fight against inflation. In other words, we are seeing economic data points, in early May, that contradict those of early April.

From one month to the next, economic data fluctuate greatly. It seems to have become the norm in this post Covid era, making life a bit of a hell for people in the business of forecasting.

First inflation was supposed to be transitory, then it became entrenched, now it is on the wane but with upswings here and there such as in the past three months. Nothing seems to be going in a straight line. Maybe we should not be so surprised by this. Covid was nothing but a highly exceptional event. With that came exceptional responses, at the individual and collective levels. Those responses were hard if not impossible to anticipate. Their consequences are not yet fully understood or felt (a case in point here would be the effects of the crisis on the commercial real estate sector).

The market volatility that we are currently experiencing seems to be the latest manifestation of this state of things. It may take another year or more for the economic environment to fully stabilize.

For now, the most encouraging piece of information for equity investors remains the relatively solid corporate earnings that we are seeing. The market will avoid a meaningful correction as long as corporate earnings remain healthy and will push forward if/when the FED decides the time has come to reduce interest rates.

Thank you for your continued trust!

Jeff de Valdivia, CFA, CFP

Fleurus Investment Advisory, LLC

www.fleurus-ia.com

(203) 919-4980