Overview

What an exciting month March was!

A (mini) banking crisis, sparked by the collapse of a little-known California bank, made equity markets particularly difficult to navigate. Nevertheless, the month finished relatively well in the end, as shown by most equity and bond indices.

The S&P’s 500 rose 3.67% and the Nasdaq Composite a potent 6.78%. Emblematic of the uncertainty, however, was the performance of the Small Cap index (down 4.78%). Sectorial and factor rotations this year have been nothing short of breathtaking at times.

Internationally, the EPAC BM index of developed economies added 1.71% and Emerging markets were up 3.03% (MSCI EM). The USD dropped 2.33% against a basket of key currencies, confirming the global “risk-on” mood, during the second part of the month.

The US bond market rose overall, benefitting from investors’ (exaggerated) fear of a major financial crisis.

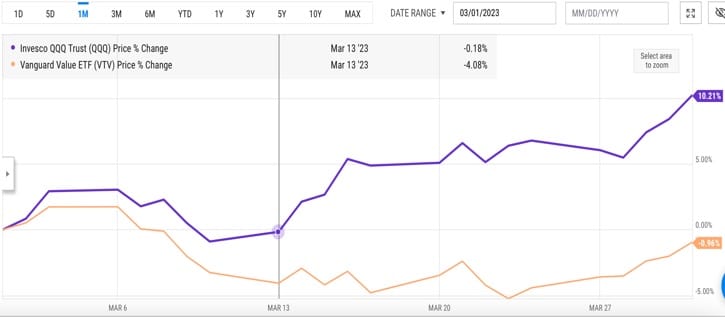

Below is a chart that illustrates both market volatility as well as the sharp divergence in performances from one sector of the US equity markets to another.

The purple line is that of QQQ, an ETF that tracks the performance of “growth” companies. It was up 10% last month. Contrasts this with the performance of VTV, an ETF that tracks “Value” companies. It was down .96% during the same period. Being exposed to the “right” sector of the equity market makes all the difference in this volatile environment.

In March, our median portfolio gained 2.24%. Over the same period, a portfolio consisting of 50% ACWI (All Country World Index) and 50% AGG (US Bond Aggregate) rose 2.99%. YTD, our median account is up 3.38% vs. 5.32% for our reference index.

Market developments

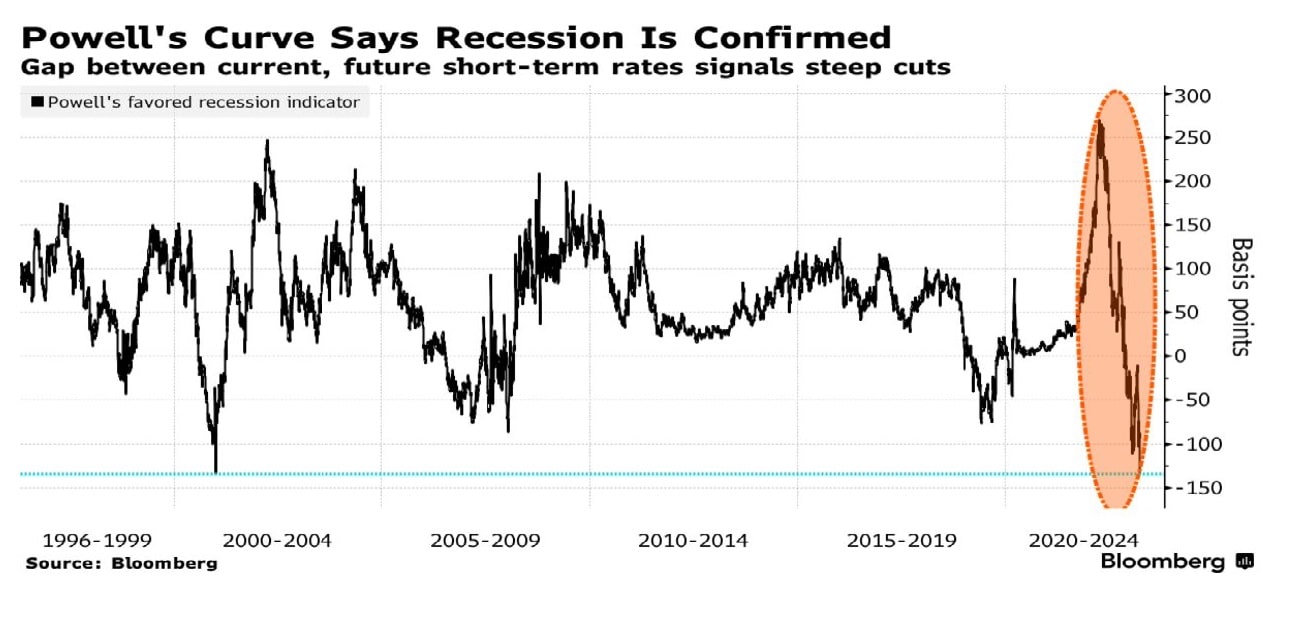

The month of March can be split in two parts around the pivot day of March 8; before and after the bank crisis erupted. Before March 8, most of the discussion and investment behavior resulted from the dissonance between what the Federal Reserve (FED) said they wanted to do: raise interest rates further and for as long as needed AND, the market perception that the FED would not be able to do so, due to concerns about an impending economic recession.

Depending upon which story dominated the discussion of the day, markets would go down (FED is right) or up (market is correct). The chart below illustrates how finding out what will prevail may prove complicated as both narratives may be right.

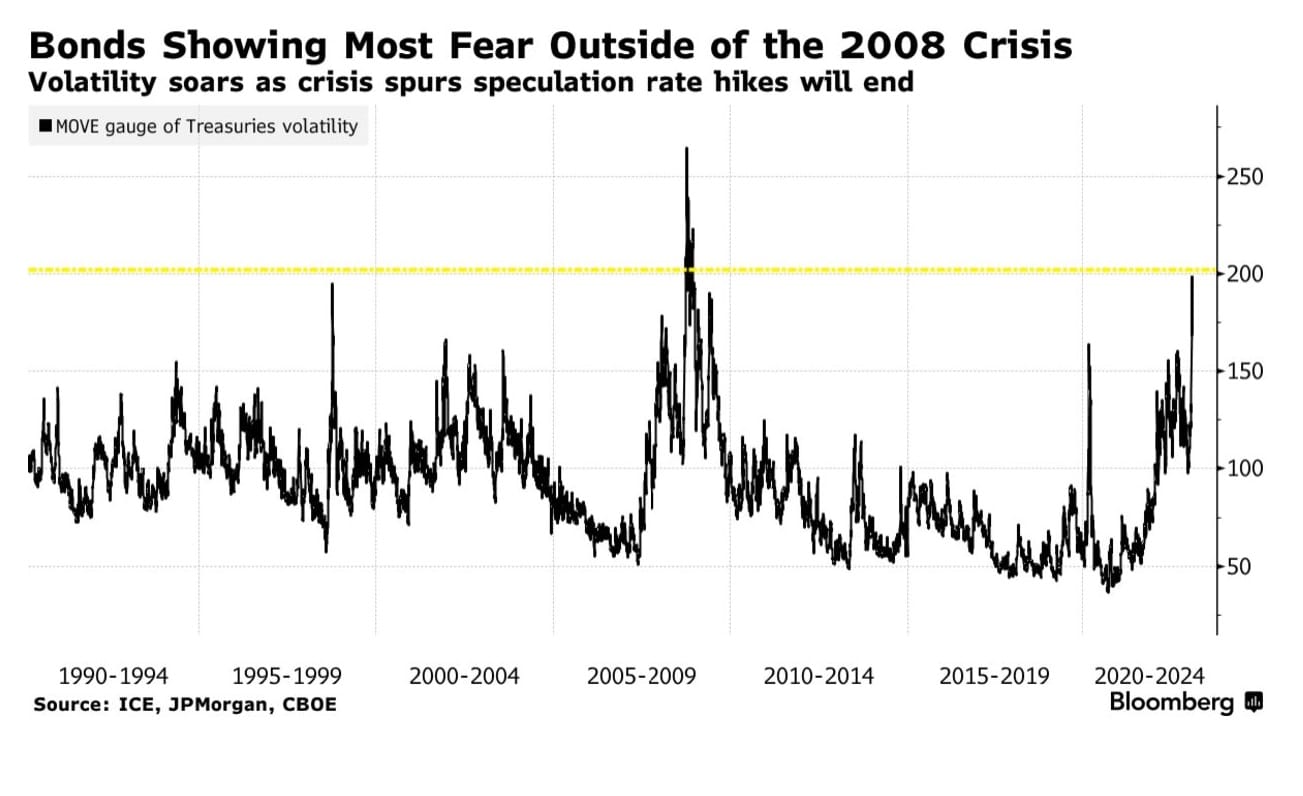

After March 8, the conversation changed. Investors conflated the collapses of Silicon Valley Bank (SVB) and that of Signature Bank, both totally unanticipated events, with the problems at Credit Suisse, a bank that has been troubled for years. This caused panic and fears of a financial meltdown.

While the two issues have very little to do with each other, the market reaction was to sell bank shares and to buy government bonds. The chart below illustrates, in part, this development:

Tilts and Allocations

The forceful interventions of financial regulators in the US and in Europe appear to have stopped the panic that saw the shares of many US regional banks sink 30% in a few days.

As is often the case in times of panic; opportunities arise. Schwab saw their stock price drop by close to 30% in March, although their situation is very different from that of most US regional banks. I scooped a few shares and stand ready to buy more, should the stock drop further.

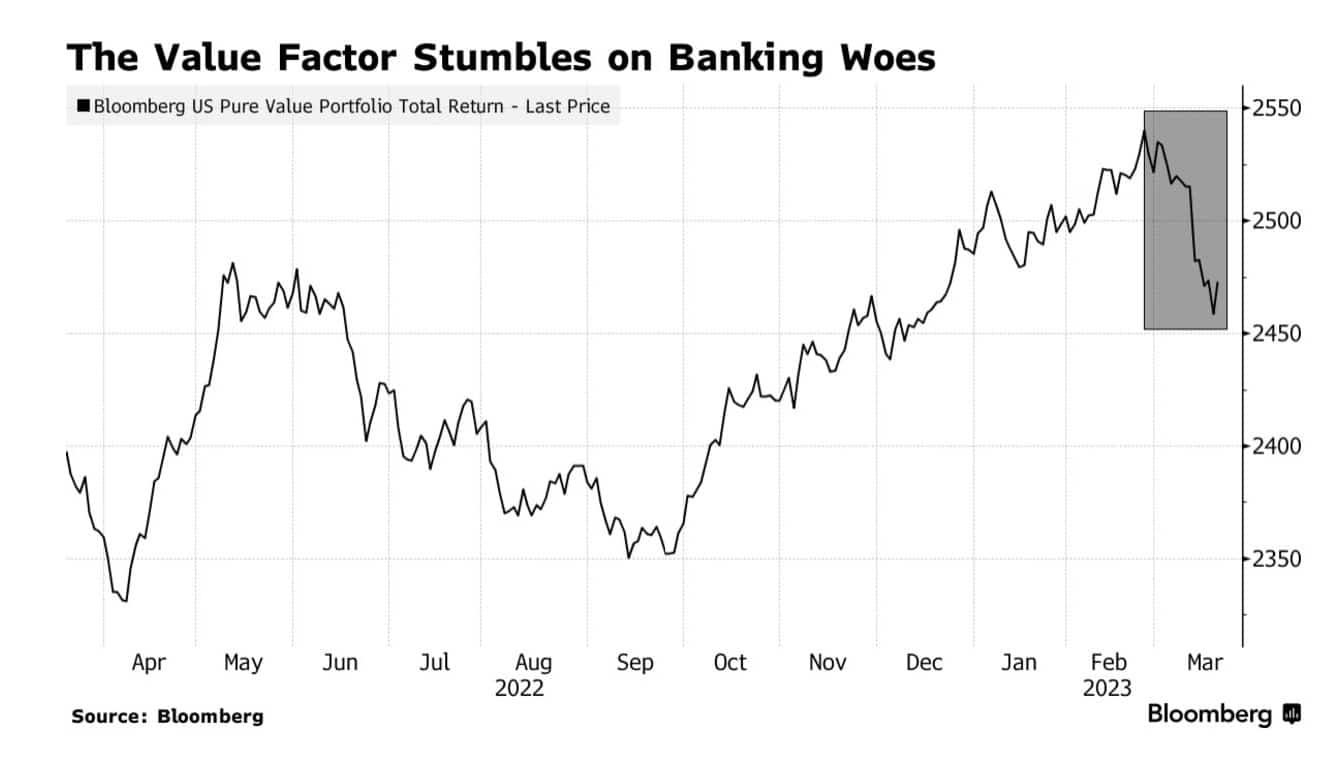

Outside of this opportunistic investment, I sold 1/3 of our position in VTV, a value stock ETF, in favor of SPY and, a few days later, cut it further to buy QQQ, a Nasdaq ETF tracker. This helped us over the second part of the month.

The banking crisis has exacerbated the sectorial rotation out of value stocks and into growth stocks. While this movement started with the new year, it has gained momentum recently, as illustrated below:

Whether our relative switch from value to growth proves beneficial for more than a few weeks depends on the trajectory of the US economy and of the FED’s monetary policy. If the FED pushes interest rates up a bit less than their current rhetoric implies, this investment decision should prove accretive.

Conclusion

After this past month, I feel like a boxer who has been bruised and shaken. My opponent is uncertainty; the uncertainty that the FED’s monetary policy has caused to increase.

Whether the FED chooses to squash inflation at the expense of the economy or not remains unclear to me. What I believe though is that its ability to stem inflation without causing serious economic damage has become highly questionable, if not impossible.

Consequently, market volatility will remain high for the foreseeable future and investors must gird themselves accordingly.

Please feel free to reach out to me with any questions. Thank you for your continued trust.

Jeff de Valdivia, CFA, CFP

Fleurus Investment Advisory, LLC

www.fleurus-ia.com

(203) 919-4980