Overview

March was another good month for equities worldwide and US equities, in particular.

In March, the S&P’s 500 rose 3.22% while the Nasdaq Composite was up 1.85%. The Russell 2000 (Small Cap Stocks) increased 3.58%. In international markets, the EPAC BM Index of developed economies (ex-US) rose 3.06% and the MSCI EM (emerging markets) 2.18%.

The main reason behind this good performance, other than the continued good health of the US and global economy, was the tenor of FED Chairman Powell’s testimony to Congress on March 6 and the subsequent results of the FOMC meeting of March 18-20 (Federal Open Market Committee). The chart, below, illustrates these points:

The vertical line marks the beginning of the FOMC meetings. Prior to the meetings, the S&P’s 500 was up about 1% for the month, mostly the consequence of a positive testimony by Chair Powell to Congress on the health of the US economy on March 6 and 7. Two thirds of the month advance came about during and after the FOMC meetings (to the right of the vertical line) as the tenor of these meetings showed that most FED governors were inclined to reduce interest rates three times before the end of 2024. That general consensus emanating from the US Central Bank lifted investors’ hope and propelled the market another 2% up.

Fixed income markets were relatively stable to slightly positive during the month. The AGG index was up about 1% while Investment Grade and High Yield corporate bonds added about 1.25%.

In March, our median portfolio gained 2.78%. Over the same period, a portfolio consisting of 50% ACWI (All Country World Index) and 50% AGG (US Bond Aggregate) rose 2.09%. YTD our median portfolio is up 5.10% vs 3.74% for our reference index.

Market developments

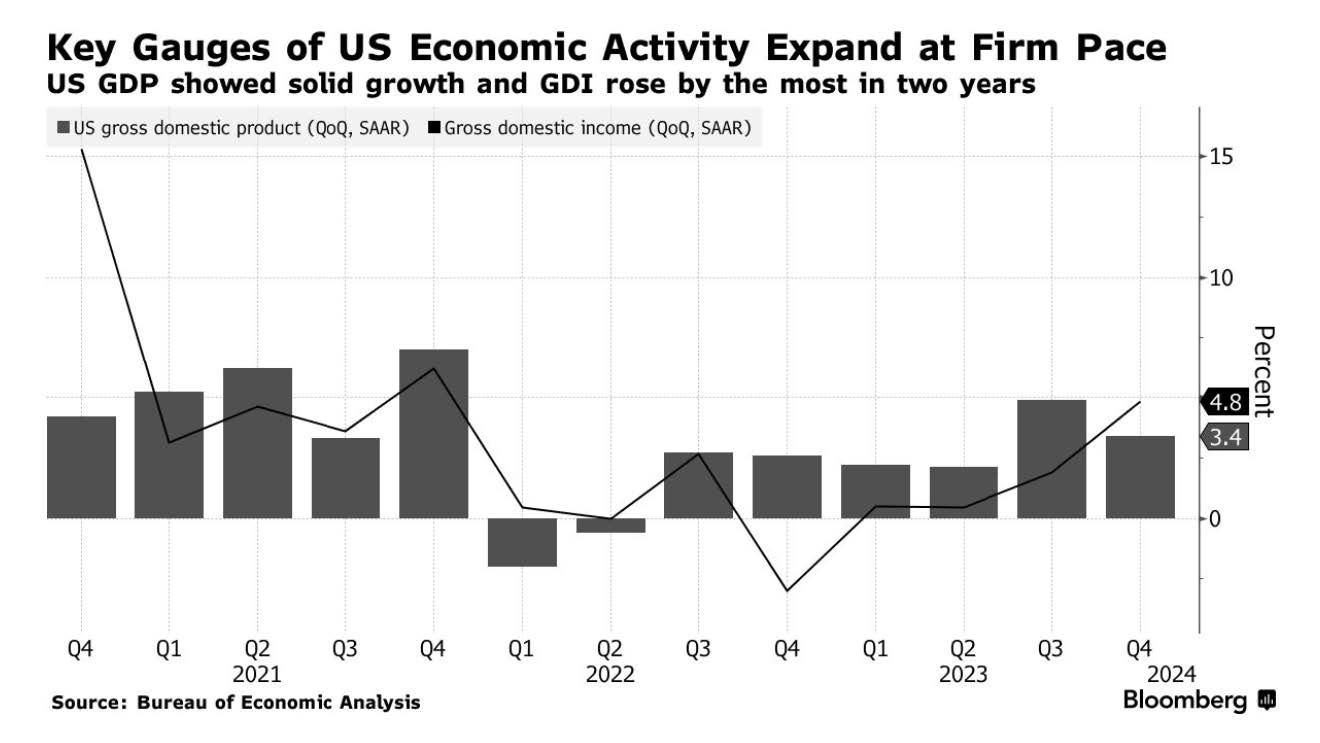

While Chair Powell provided the triggers for markets to go up in March, the fundamentals of the US economy justify it. Here is the first reminder of the good health of our economy:

US GDP growth for the fourth quarter of 2023 was a robust 3.4% (as a reminder, this number represents performance after stripping the effects of inflation). This is a strong number.

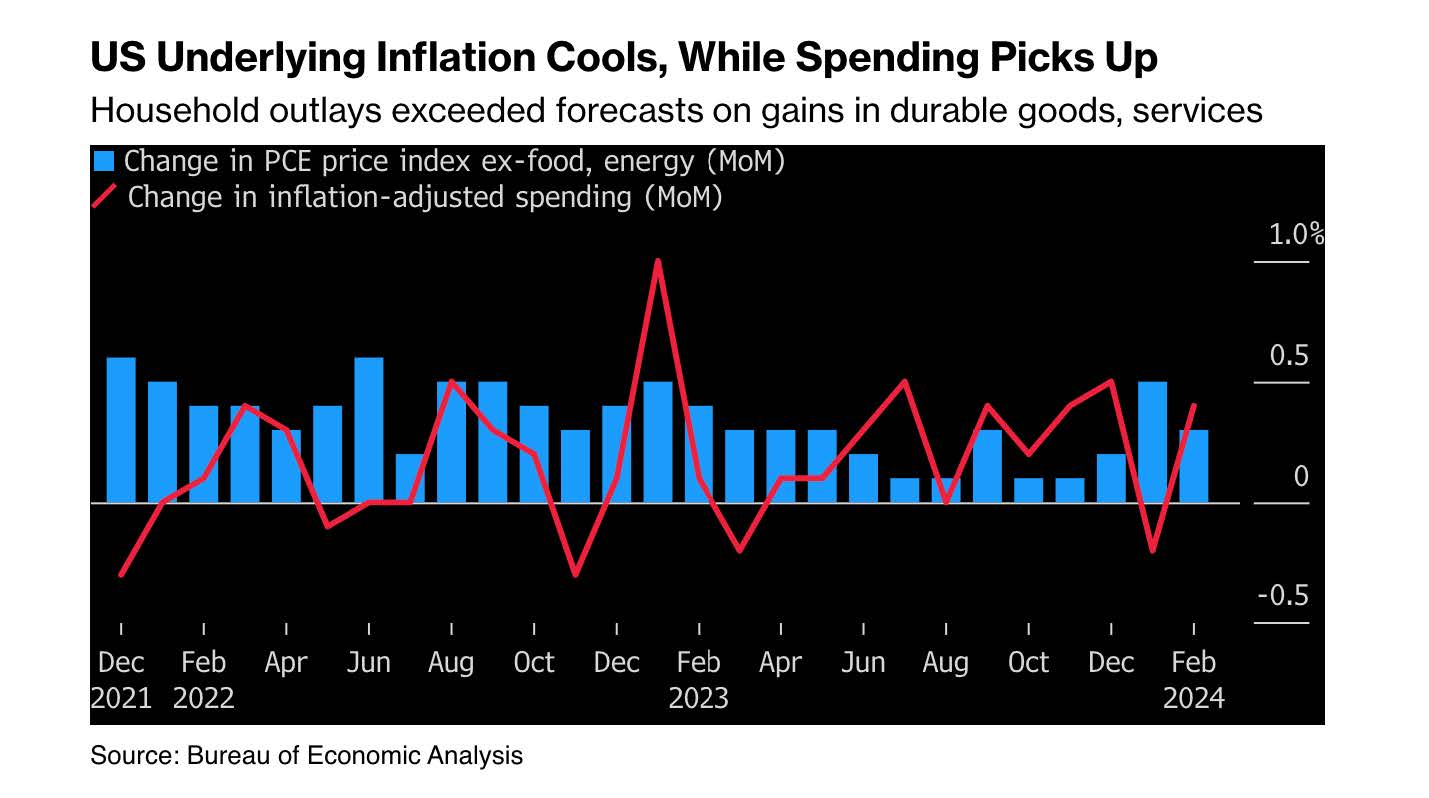

As for inflation, well, the news remains good as illustrated below:

It would be hard to find a better economic environment.

The US consumer seems to be happier by the day, manufacturing is humming and inflation is on the wane and/or kept at a manageable level.

Portfolio Commentary

The past month saw an interesting development: The relative outperformance of value stocks against the technology sector. This had not happened in a long while.

Below is a chart showing the performance of QQQ (Nasdaq 100 ETF) vs. that of VTV (the Vanguard Value ETF) since the beginning of 2024.

After a fast start in January and February for QQQ, both ETFs are now up about 8% as of the end of March.

However, VTV outperformed QQQ significantly in March, as shown below:

VTV was up over 4% in March while QQQ was up slightly over 1%.

This could be the beginning of a rotation, long in the making, away from tech and in favor of “anything that is not tech…”. Valuations in the tech sector are high, but not insane yet. So, a move away from tech, even on a relative basis, must be effected cautiously.

Nevertheless, there is more and more evidence that, with a US economy performing well, the relative outperformance of technology stocks should come to an end and spread to other sectors. We are positioned to take advantage of this move, should it materialize.

Conclusion

As I write these lines, the US equity markets are experiencing their second day in April of negative performance.

The negativity is attributed to better-than-expected manufacturing data, released yesterday, that lessen the case for the FED to loosen its monetary stance soon. The spike in bond yields has been significant. The 10-year US treasury has gone from a yield of 4.20% last Friday to about 4.40% today.

After a spectacular first quarter, a slight retreat is not unexpected. Right now, there is very little that would justify reducing our overall risk posture, other than aggravating circumstances in US and global politics.

Thank you for your continued trust!

Jeff de Valdivia, CFA, CFP

Fleurus Investment Advisory, LLC

www.fleurus-ia.com

(203) 919-4980