Overview

US equities and, to a lesser extent, international equity markets delivered another spectacular performance this past month.

In February, the S&P’s 500 rose 5.34% while the Nasdaq Composite was up 6.22%. The Russell 2000 (Small Cap Stocks) increased 5.65%. In international markets, the EPAC BM Index of developed economies (ex-US) rose a relatively muted 1.73% and the MSCI EM (emerging markets) a more significant 4.63%.

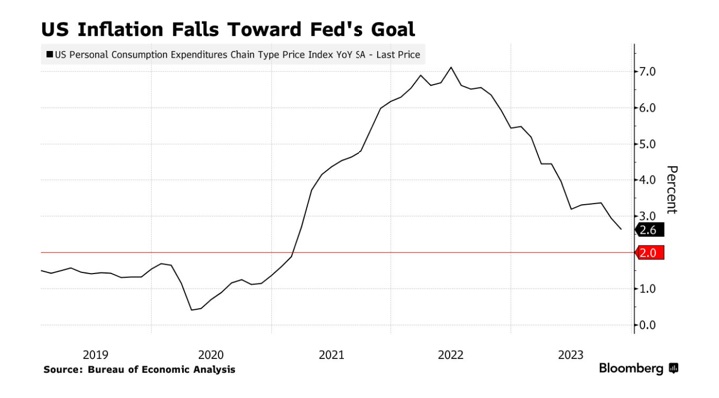

A combination of spectacular tech stock earnings and strong US economic numbers contributed to the exceptional performance of most indices. In addition, the trend for US inflation remained unbroken, in spite of less spectacular progress in February. The graph below illustrates the continued improvements made on that front. At the end of January, the US PCE Index (Personal Consumption Expenditure), a measure of inflation that the FED pays particular attention to, stood at an annual rate of 2.40% (the 2.60% shown below does not include the latest data point released in February).

US fixed income markets were less well disposed. As the US economy continues to surprise to the upside, the chances of the FED reducing interest rates rapidly recede a bit more into the future. While nobody questions the likelihood of an interest rate reduction, in the coming months, its timing remains less clear. To compensate them for that added uncertainty, bond investors are now demanding higher returns. As a result, the AGG index went down 1.41% in February.

In February, our median portfolio gained 2.57%. Over the same period, a portfolio consisting of 50% ACWI (All Country World Index) and 50% AGG (US Bond Aggregate) rose 1.52%. YTD our median portfolio is up 2.40% vs 1.59% for our reference index.

Market developments

The month started with upbeat earnings reports from a few tech giants (Microsoft, Amazon and Meta in particular). That put investors in a good mood causing equities to rise 2% to 3% in the first five trading days of the month.

The graph below illustrates the amazing performance of the tech sector (top line) in an environment where credit issues afflicting regional banks could have muted or even negated its effects on the equity market overall. But they did not. The tech sector is pulling the market forward, the way it did in 2023.

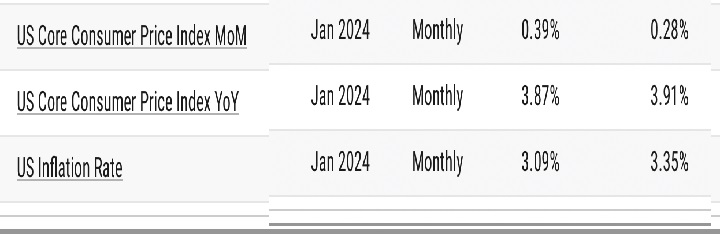

This is occurring in spite of weakness in regional banks due to rising losses in commercial real estate loan portfolios and decreasing chances of the FED reducing its benchmark interest rate in March. They are practically nil as of this writing. Both factors did not play out negatively in February, other than very temporarily. This is in part due to an overall inflation picture that remains positive and that will, eventually, lead the FED to reduce the Fed Funds rate, which will in turn help the banking sector overall and regional banks, in particular. The latest data on that front are shown below: The (%) column on the left provides the latest information (month of January) and compares it to that of the prior month (right column).

Portfolio Commentary

In February, I found no need to adjust most portfolios. Our few idiosyncratic positions performed well and our current allocation is in line with where I want portfolios to be, given the current environment.

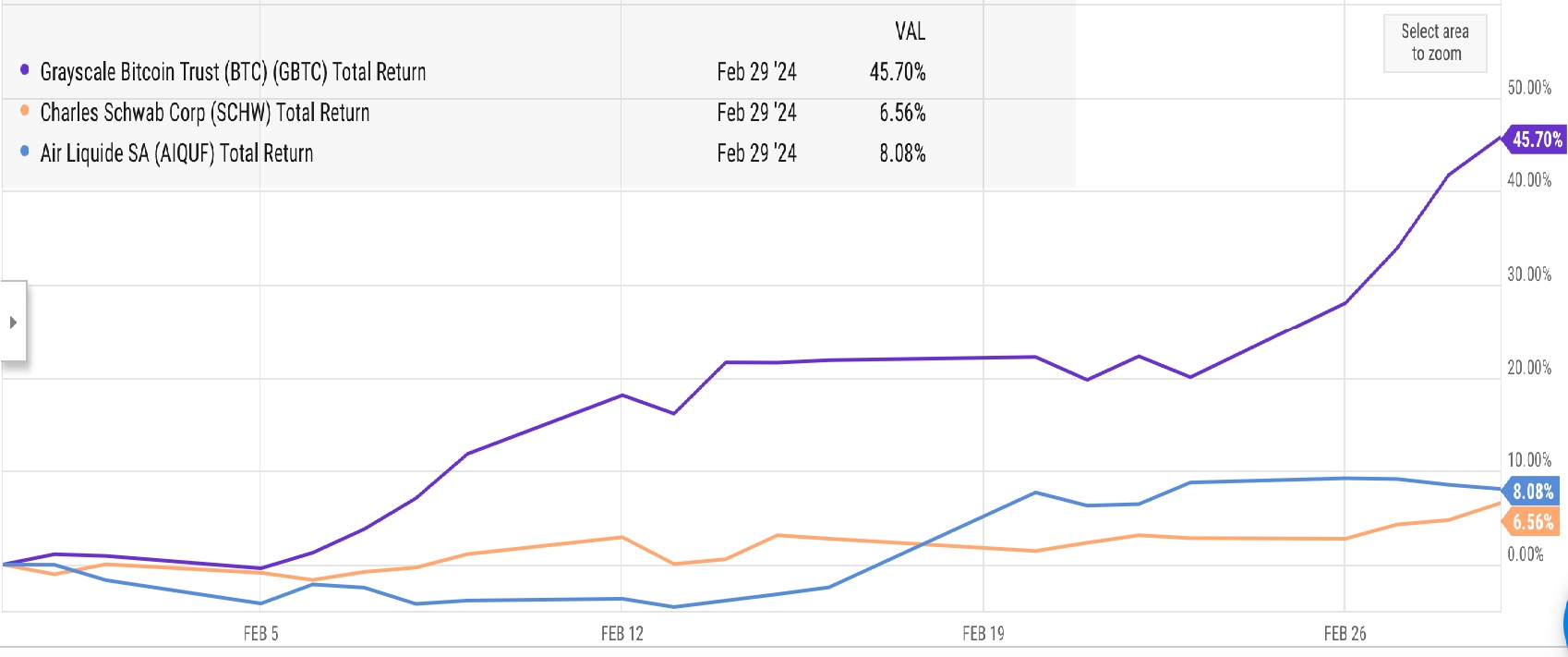

Below is the graph of the performance of our three single stocks (or equivalent) investments, this past month:

In February, each one of them performed spectacularly well.

In retrospect, reducing our position in GBTC in January, for those of you who own the Bitcoin investment vehicle, was suboptimal. We missed part of the February rally as a result. That said, GBTC went up 250% in 2023 and I remain satisfied with my decision to take about half of our 2023 earnings off the table. At some point, the frenzy will stop, and a violent reversal might take place. Knowing when to sell or reduce exposure is quite difficult in any circumstance. In the crypto sector it is a fool’s errand.

Elsewhere, SCHW (Charles Schwab) recouped most of its January losses. As of this writing, the share price continues to move towards the $80/share level that I am targeting/looking for as an exit point.

Finally, on February 22, Air Liquide announced above expectations earnings for 2023 and its last quarter. The stock went up 10% that day to finish the month up 8% overall. AIQUF is a long-term investment that I have no intention of exiting in the foreseeable future.

Their positioning in the de-carbonization of our planet is enviable, their management continues to execute well and, historically, the shares have delivered above average returns for patient investors.

Conclusion

One could be concerned with the sustainability of the current rally. After all, the S&P’s 500 is up about 25% since the end of October 2023.Yet, equity valuations have not

reached the levels that we saw in 2000, when a decade of internet-related innovations created the bubble that then blew investment portfolios up in March of that year.

Artificial Intelligence appears to be a game-changer, on par with the internet revolution, for the US and for the global economy. It could very well justify the current investors’ enthusiasm for anything related to it.

With earnings continuing to surprise, inflation continuing to decline or moderate and a FED that cannot indefinitely justify not reducing its benchmark intervention rate, the market has sensible reasons to move up. Even more as wellresearched estimates on the timing of an eventual (AIrelated) bubble burst are pushing it to 2025 or 2026.

I remain nevertheless less sanguine that I would otherwise be, under similar economic circumstances. My relatively positive picture is somewhat tarnished by investment concerns that do not come from the economic environment but rather from a sphere of human activity that they are usually immune from. Politics do not matter for investors

and markets about 99% of the time (not a scientific measurement). Except, when we go through the 1% of times when they do. Extreme political animus, stateside and geopolitically, may already have brought us in that 1% of times when political instability does impact investment decisions in a major way.

Rebellions, wars, extreme economic distress do cause market dislocations when going unchecked/uncontrolled for long periods. I am concerned that we have entered such a period. It causes me to remain prudent and to forego adding to our equity investments, at a time when such a decision might be justified based on economics only.

Thank you for your continued trust!

Jeff de Valdivia, CFA, CFP

Fleurus Investment Advisory, LLC

www.fleurus-ia.com

(203) 919-4980