Overview

US and World equity indices were sharply up again in November on the back of lower-than-expected inflation numbers and signs of an economic slowdown in the US and in the rest of the world.

The S&P’s 500 rose 5.59%. All other US equity indices fared similarly except for the Small Cap Index that registered a positive performance of 2.34% only.

Internationally, the EPAC BM Index of developed economies increased a robust 10.99%, with an additional lift from a depreciating USD. Emerging markets increased a whopping 14.83% (MSCI EM).

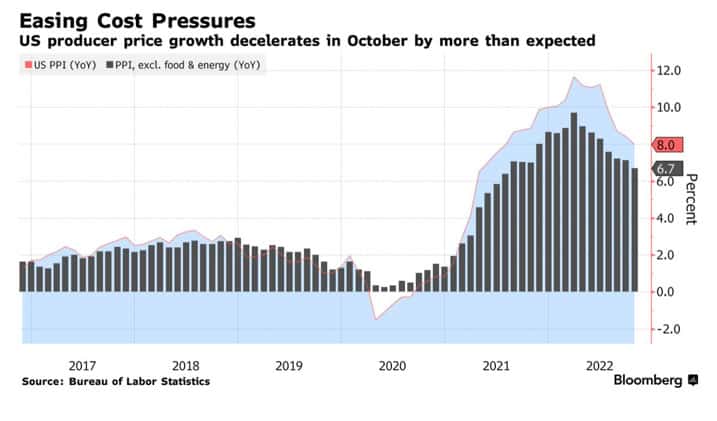

The bond market rallied too. The long bond gained 7.07%. It has nevertheless lost 28% so far this year. Elsewhere in the fixed income sector, the S&P’s Muni index rose 4.73% and the high yield Bloomberg index rose 2.17% Below is a chart that illustrates the dropping cost pressures in the US economy. As US producers experience lower cost pressures, whether due to waning covid-related dysfunction or dropping commodity prices, we, as consumers, will see

inflation go down.

In November, our median portfolio gained 4.32%. Over the same period, a portfolio consisting of 50% ACWI (All Country World Index) and 50% AGG (US Bond Aggregate) rose 6.08%. On a YTD basis, our median portfolio has lost 15.08% vs. 13.34% for our index. As a reminder, the equity allocation in our clients’ portfolios varies currently from 40% to 70%, depending on risk profile.

Market developments

A particularly good CPI number for the month of October, published on November 11, is the single most important event that explains the good performance of equities this past month.

The core CPI dropped to an annual level of 6.3% vs. an expected 6.6%. This helped bring the CPI (including food and energy, its two most volatile components) to 7.7% on a comparable basis when a 8.20% number was expected. Stocks rallied 3% to 4% on the day.

While Fed governors were prompt to indicate that one positive inflation number was insufficient to justify a “pivot” (that’s the current market term used to express the expected change of magnitude of the Fed’ coming interest rate increases), investors felt that an impending change was likely.

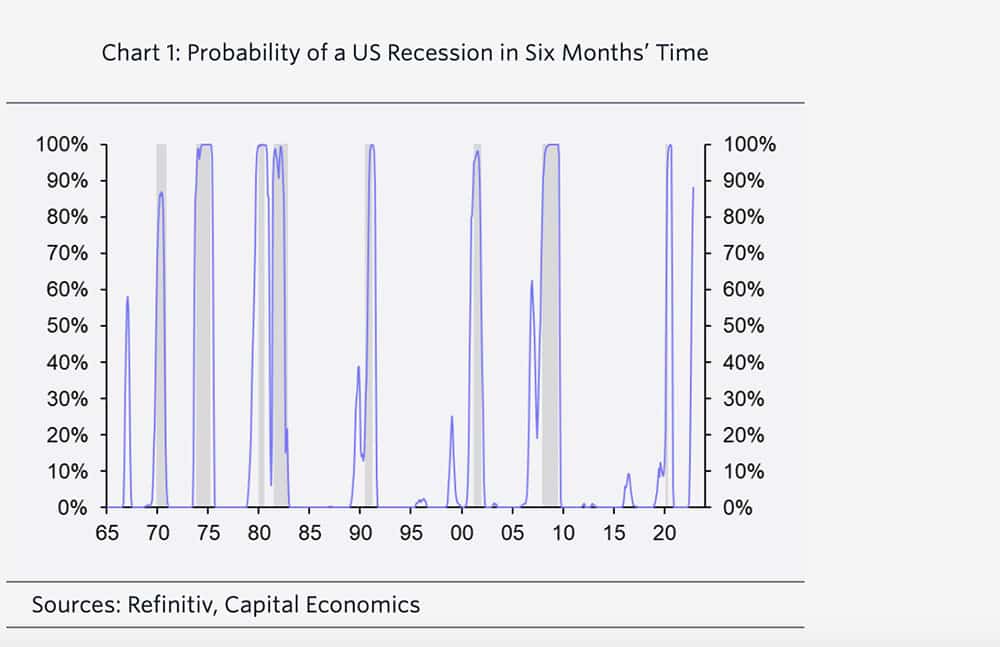

The market was comforted in that thought as more and more economists anticipate a US recession in the first half of 2023. This would make a continuation of the Fed’s restrictive interest rate policy harder to justify.

The odds of a recession have increased as illustrated below:

At close to 90%, the odds are not favorable and should be giving the Fed some pause, particularly if the next inflation data point, in mid-December, confirms the positive recent turn of events on that front.

Tilts and Allocations

In November, I increased our US equity allocation. I did so mostly by investing some of our cash in SPY, the S&Ps’ 500 ETF tracker. My thinking was that if inflation were going to drop eventually (which it did), growth stocks would again benefit disproportionately. SPY is invested in large growths stocks to the tune of about 30%.

Generally, I increased our US equity allocation by 3% to 4%.

I left our non-US allocation equity allocation intact. This is because I believe that the unusual and rapid rise of the USD in 2023 is likely over. This, in turn, should benefit our non-US holdings.

The above chart illustrates the negative correlation between the value of the USD (orange line) and the performance of non-US equities (purple line). The vertical line marks the beginning of the month of November. Since that time, the USD has lost about 5%. Over the same period, non-US equities have gained 13% (in USD terms).

I expect this momentum to continue, with ups and downs, over the next few months. This could be upended by a return to high inflation, but the odds of that happening are diminishing.

Conclusion

On the assumption that inflation in the US and worldwide has already passed its peak, one major impediment to rising equity markets has been removed. The next one, should come in the form of a less restrictive monetary policy from the US and other central banks around the world. The odds of that are rising too. All this is positive for equities globally.

What is not is the risk of a recession. It is increasing and that automatically leads to lower corporate earnings, the main engine of equity performance.

As of now, the difficulty that investors face is to accurately weigh the odds of lower corporate earnings in the next two or three quarters against the positive news associated with lower inflation and of a more accommodative monetary policy.

I don’t expect the first and/or second quarter of 2023 to bring spectacular equity gains unless inflation collapses AND corporate earnings hold firm. This is an unlikely development.

More realistically, investors should prepare themselves for a meandering market performance over the first six months of 2023, followed by a firmer market environment as recession risks (hopefully) fade.

Please feel free to reach out to me with any questions.

Thank you for your continued trust.

Jeff de Valdivia, CFA, CFP

Fleurus Investment Advisory, LLC

www.fleurus-ia.com

(203) 919-4980