Overview

In January, US and World equity indices had one of their best months in a long time. Economic data pointing to a resilient US economy, a better performing European one and China’s removal of any Covid-related restrictions provided a favorable environment and the impetus for a general “risk-on” move.

The S&P’s 500 rose 6.28%. The Nasdaq Composite was up 10.72%. Internationally, the situation was as good or better. The EPAC BM Index of developed economies rose 8.19%, helped in part by a weakening USD (down 1.33% this past month). Emerging markets were up too (7.90% for the MSCI EM). The US bond market rallied too but less significantly.

The long bond gained 6.41%. Elsewhere in the fixed income sector, the S&P’s Muni index rose 2.82% and the high yield Bloomberg index 3.28%.

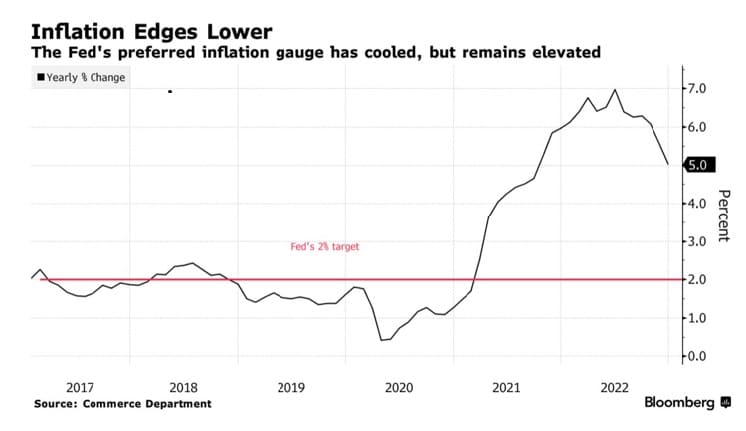

Below is a chart that illustrates the other major economic data behind the January stock rally.

Market developments

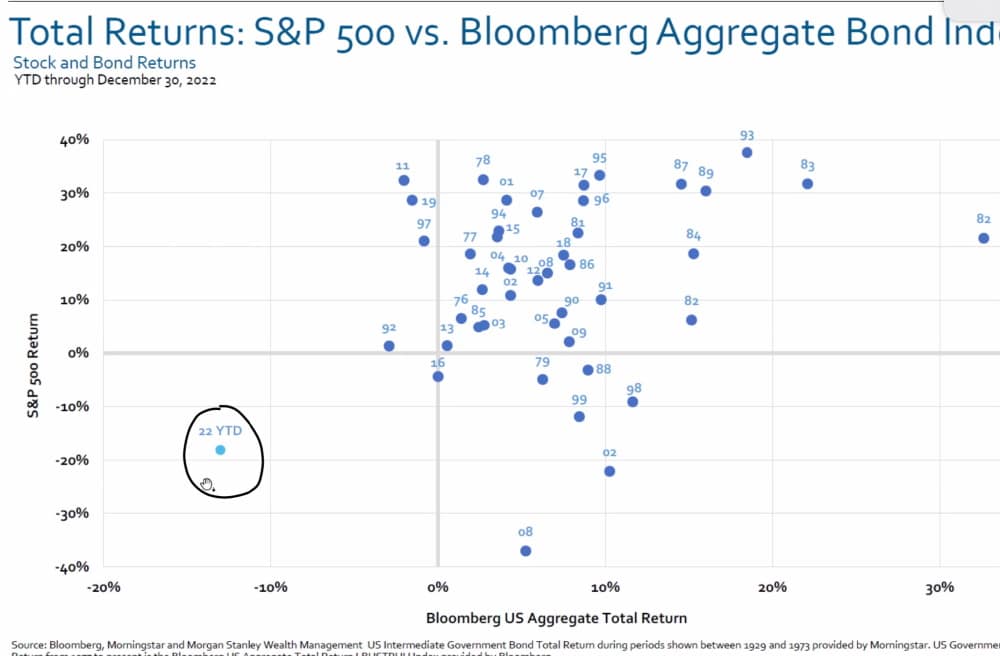

Before going into the market developments in January, I thought I would share the remarkable chart below with you. It shows how exceptional 2022 was for investors, when compared to yearly performances over the past forty years.

The horizontal axis measures the annual returns of the US bond market, starting with negative performances on the left. The vertical axis does the same with the S&P’s 500, starting with negative annual performances at the bottom. The lower left quarter of the chart includes the rare instances of double negative performances (when both the S&P’s 500 and the bond market register negative performances). I circled the 2022 data point. For those investors who despaired in 2022 after seeing their portfolios cut down from 15% to 30%, depending on sectorial allocations, a repeat performance in the near future is quite unlikely.

Economic data in January pointed to a weakening but still robust job market in the US. Coupled with decent manufacturing data (ISM at the beginning of the month) and stronger than expected GDP numbers (at the end of the month), the overall economic picture just did not fit with a recessionary environment.

Investors took those data points and the good inflation news to mean that the Fed was almost done. Perhaps this is an overly optimistic view but nonetheless one that explains the staggering rally in equities. The Fed Chairman, in his post-FOMC announcement, on February 1, indicated that he and other members of the Fed’s board of governors needed more positive inflation news before declaring victory and stopping the interest rate tightening cycle. The markets want to rally but the Fed says: “not so fast”. We will soon see who prevails in the end.

Tilts and Allocations

In January, I continued to reinvest in US bills as they matured, and I increased our exposure to European equities. Specifically, I bought EWG, the German stock ETF. With the Eurozone doing better than anticipated, its economic engine should finally start delivering for investors after years of underperformance.

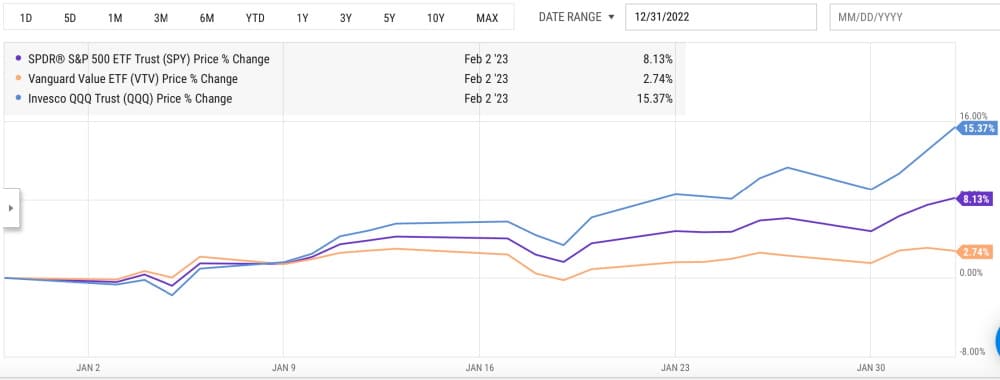

A significant sectorial shift has been taking place in the US since the beginning of the year. Growth equities (Nasdaq) have found favor again with investors, at the expense of Value equities. In other words, what worked in 2022 (Value) does not seem to work at the beginning of 2023.

The chart above illustrates the contrasted performances of QQQ

(blue), SPY (purple) and VTV (orange), from January 1 onwards, where QQQ is the Growth equities ETF, SPY is the S&P’s ETF and VTV, the Value equities ETF. The huge shift in favor of Growth since the beginning of the year, at the expense of Value, explains our relative underperformance in January. As far as our US equity exposure is concerned, we are mostly allocated to VTV. While this served us relatively well in 2022, it is not helping currently.

The question is: Is the shift to Growth equities premature (as it proved to be in August of last year) or is it more sustainable this time around? It will endure if the Fed pivots rapidly and if corporate earnings that have been trending downwards do not accelerate in that direction or even reverse.

History is on the side of the Fed. At this juncture, the Fed signals that it will increase its reference interest rate one or two more times. This would mean that the current rally is a bit premature. On the other hand, history may not be the best guide in a post-Covid economic environment. I have decided to stay put for now and not yet modify our sectorial allocations.

Conclusion

The economic data to be released in the next few weeks including mostly, unemployment, inflation-related and additional corporate earnings, should help confirm whether the current “risk-on” environment is justified or premature.

We will maintain a wait-and-see attitude in the meantime.Please feel free to reach out to me with any questions.

Thank you for your continued trust.

Jeff de Valdivia, CFA, CFP

Fleurus Investment Advisory, LLC

www.fleurus-ia.com

(203) 919-4980