Overview

In January, the continued strength of the US economy contributed to a mixed US equity market performance and to a mild deterioration in the bond market. Meanwhile, the sharp upward move of the USD, caused by rising bond yields, led to a generally negative performance for international equity markets (from a US investor’s perspective).

In January, the S&P’s 500 rose 1.68% and the Nasdaq Composite was up 1.04%. The Russell 2000 (Small Cap Stocks.) declined 3.89%. In international markets, the EPAC BM Index of developed economies (ex-US) declined .38% and the MSCI EM (emerging markets) a more significant 4.63%.

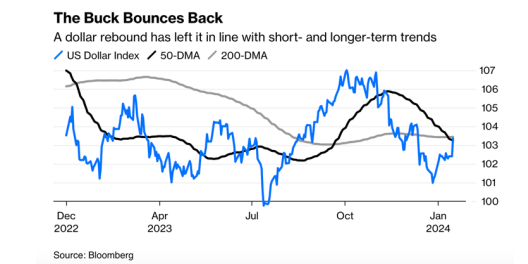

International markets were hit by the combined effects of rising tensions in the Middle East and a strengthening USD, the two developments being related. The chart that follows illustrates the recent rise of the USD:

Since the end of 2023, the USD has gained about 2.7% vs the € and about 2.20% vs. a basket of major currencies. Most of the move can be explained by rising US bond yields. Those rising bond yields caused the US long bond to lose 2.2% in January. Elsewhere in the US fixed income markets, the broad US aggregate lost .27% while the municipal sector was down .51%.

In January, our median portfolio lost .40%. Over the same period, a portfolio consisting of 50% ACWI (All Country World Index) and 50% AGG (US Bond Aggregate) rose .07%.

Market developments

Stronger and better than expected economic data for the US economy contributed to a tug of war in January. On the one hand, good employment, consumption and production numbers clearly supported the notion that the US economy remains healthy and is nowhere near a recession. On the other hand, they contributed to reducing the likelihood that the Federal Reserve (FED) would reverse course and push its intervention rate (Fed Fund) down a notch in March. As that realization sunk in, investors moved in and out of equity sectors and pushed bond yields up. This caused the overall US equity market to behave in a somewhat confused manner and explains the dispersion in performances between large caps, tech stocks and small caps. Investors appear a bit unsure of the next market move, if still generally positive.

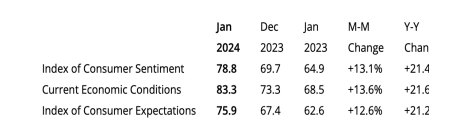

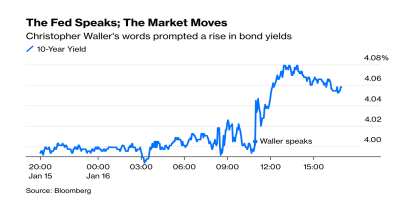

The following two graphs illustrate those opposite forces at play.

The US consumer appears to be feeling better. This is good for the economy.

On the other hand, good economic numbers tend to support rising bond yields, an environment that can be detrimental to sustained and positive equity market performance, particularly if the FED adds to uncertainty.

Portfolio Commentary

In January, I added to our AGG investments in order to extend the duration of our fixed income investments and to benefit from an anticipated general decline in interest rates. So far, this has failed to help performance as bond yields have risen across the yield curve instead.

For those of you who own GBTC (the Bitcoin investment vehicle), I reduced our investment ahead of the announcement of its likely change of legal status from that of a trust to that of an ETF. I decided to take a bit of our profits ahead of the announcement, after the spectacular performance enjoyed by GBTC in 2023.

Noticeable this month in our portfolios was the sharp drop (-9%) suffered by SCHW. Their fourth quarter numbers beat market’s expectations, from an earnings standpoint, but indicate that a full recovery from the losses and pain experienced last year during the March 2023 mini banking crisis, will take a little more time to heal. We are generally up 17% to 25% from our entry point and I see no reason to sell yet.

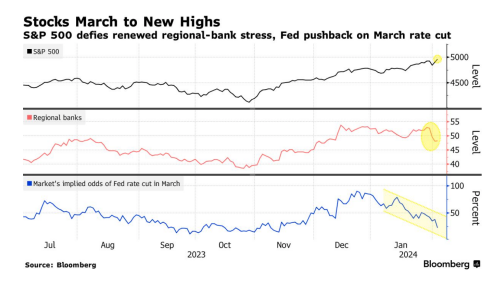

Markets are a bit tricky currently. The chart below attempts to illustrate that. It depicts some of the recent sectorial divergences in equity performances, with the top part (Large Caps S&P’s 500-black line) pushing ahead while other sectors (Regional Banks-red line) suffer; All of this occurring in an environment of declining odds of a FED’s rate cut in March (blue line).

Conclusion

The US economy is doing fine. Better than fine in some instances (productivity, employment). Inflation appears tamed. The FED will probably not act in March, against my year-end expectations, out of prudence mostly. They want to see more of a confirmation of the downward inflationary trend of the past six months before reversing monetary policy.

They can’t wait forever though. Should the next release of CPI data, on February 12, confirm previously released inflation data, their non-action could make investors legitimately concerned that their stance is overly restrictive.

After all, real interest rates (*) at close to 3% do tend to constrain an economy. In that environment, maintaining a restrictive monetary stance will become harder and harder to justify.

Thank you for your continued trust and Happy New Year!

Jeff de Valdivia, CFA, CFP

Fleurus Investment Advisory, LLC

www.fleurus-ia.com

(203) 919-4980