Overview

Confusion remained the operative word for equity markets during the month of May. This confusion came from the on-going attempt to anticipate the next move from the Federal Reserve and, in a new twist, from the debt-ceiling negotiations between Republicans and Democrats in Congress.

In this environment, it is not surprising that performances were somewhat divergent. The S&P’s 500 rose .43%. However, the Nasdaq Composite catapulted 5.93% while the Russell 2000 (Small Cap Stocks.) dropped .92%. As the debt-ceiling negotiations dragged on, the USD rallied 2.43%, bringing non-US equity markets down in its wake. The EPAC BM Index of developed economies (ex-US) dropped 4.15% while emerging markets swooned 1.69% (MSCI EM).

Meanwhile, relatively robust unemployment data for the month of April, caused interest rates to rise. The US bond market declined. The US long bond dropped 2.79% and across the investment grade, high yield and municipal sectors, performances were down from .50% to 1.50%.

The chart below is familiar to you by now. It illustrates the performances of three distinct US equity indices: The Nasdaq (purple), the S&P’s 500 (orange) and the Russel 2000 (blue).

The performances of those indices were strikingly different again. Notice the sharp move up of the Nasdaq, right after the release of NVIDIA’s quarterly results (vertical line). Their earnings blew past market expectations and optimistic management comments on Artificial Intelligence (AI) added to the market frenzy over the Tech. sector overall.

In May, our median portfolio declined .63%. Over the same period, a portfolio consisting of 50% ACWI (All Country World Index) and 50% AGG (US Bond Aggregate) declined 1.10%. YTD, our median account is up 3.82% vs. 5.29% for our reference index.

Market developments

As shown in the previous chart, US equity markets remained relatively stable most of the month of May, with the exception of the Nasdaq that rose forcefully over the last third of the month for the reasons mentioned earlier.

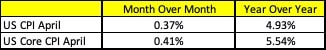

Robust employment numbers for April in the form of new jobs created (+253,000) and relatively benign, or close to expectations, inflation numbers kept the markets more of less on and even keel. Below is a table that presents where things stood, with respect to US inflation, as of the end of April:

The most significant market feature during the month of May were the on-going ups and downs associated with the negotiations in Congress over the increase of the national debt. This is the periodic congressional exercise over the raising of the debt-ceiling in order to meet the expenses of the nation associated with previously approved budget items. Most often than not, Republicans in Congress (and on rarer occasions Democrats) use this opportunity to extract concessions from the opposing/governing party. In so doing they create uncertainty over the solvency of the US Government.

This political game tends to elevate market risk. In this iteration it pushed interest rates and the value of the USD up. The most visible consequences of this being the not-so-insignificant losses experienced by investors exposed to non-US equity markets and those felt in the US bond market.

In the waning days of May, signs of an agreement became clearer. They were confirmed in early June, pushing worldwide equities close to 2 % up since.

This is where we stand currently.

Tilts and Allocations

I did not meaningfully change our allocations in May. Market developments, as mentioned earlier, did not call for action one way or the other.

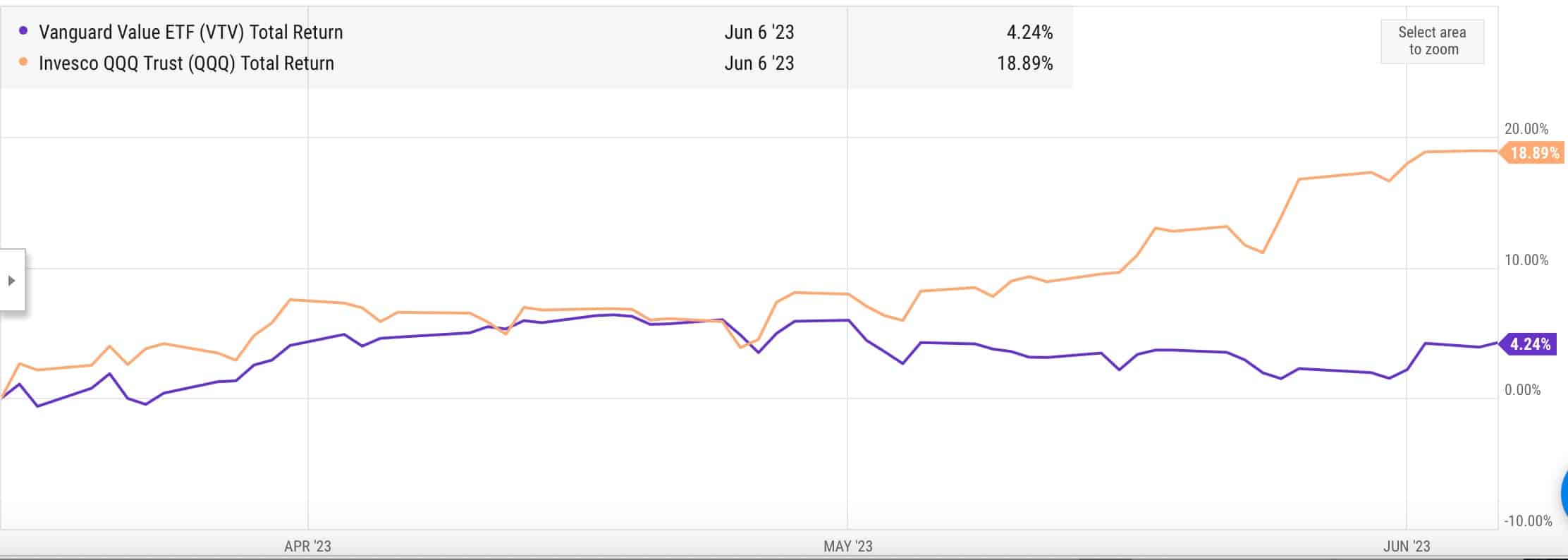

All portfolios continued to benefit from the rebalancing effected in mid-March from Value stocks in favor of Growth stocks. If you recall, at that time, I reduced our investment in VTV (Vanguard Value ETF) in favor of QQQ (Nasdaq 100 ETF) and kept them equally sized. This has been a winning move for us, as illustrated below:

Since our purchase QQQ has progressed close to 19% while VTV advanced only 4%. This spectacular difference, in such a short period of time, is not indefinitely sustainable and I will probably re-balance a bit in favor of VTV in the coming days in order to keep both investments equally sized again.

Elsewhere in our portfolio, SCHW did relatively well in May progressing 1.39%. The stock appears to have stabilized after the banking turmoil in March. I expect this stock to continue to move up over the coming months. This may not be a straight-line back to the mid $70’s though (the stock traded as low as $47 and is now around $54) . Much will depend on the next quarterly earnings.

These will show whether the anticipated margin compression that was behind their tumbling share price materializes or not. Whether it does or not will determine how quickly the stock fully recovers. In the end though, I have little doubt that it will completely recover.

Conclusion

As I finish this letter, rumblings from a softening Chinese economy are impacting equities again, particularly in Europe. The World Bank and other international institutions predict a slowdown in worldwide economic activity. They did so at the end of 2022. A worldwide “slowdown-recession” has been predicted for quite some time. It has yet to materialize.

However this economic environment is labelled, it has not prevented markets from moving up. While caution is warranted, I do not see the need to trim our equity allocation just yet.

Please feel free to reach out to me with any questions. Thank you for your continued trust.

Jeff de Valdivia, CFA, CFP

Fleurus Investment Advisory, LLC

www.fleurus-ia.com

(203) 919-4980