Overview

In February, equity markets reversed partially the gains they had accumulated in January, succumbing to another bout of anxiety over the US Central Bank’s (Fed) monetary decisions over the coming weeks and months.

The S&P’s 500 declined 2.44% and the Nasdaq Composite

dropped 1.01%. Internationally, The EPAC BM index of developed economies sunk 2.39%. Emerging markets were down a more painful 6.87% (MSCI EM). The USD rose 2.86% against a basket of key currencies, confirming the global “risk-off” mood.

The US bond market did not fare much better, declining 2.58% (US bond aggregate). The long bond lost 4.74%. Elsewhere in the fixed income sector, the S&P’s Muni index lost 2.3% and the high yield Bloomberg index a less significant 1.28%. The better than expected performance of the high yield sector is an indication that investors do not fear an economic recession as much as they do a further tightening of monetary conditions.

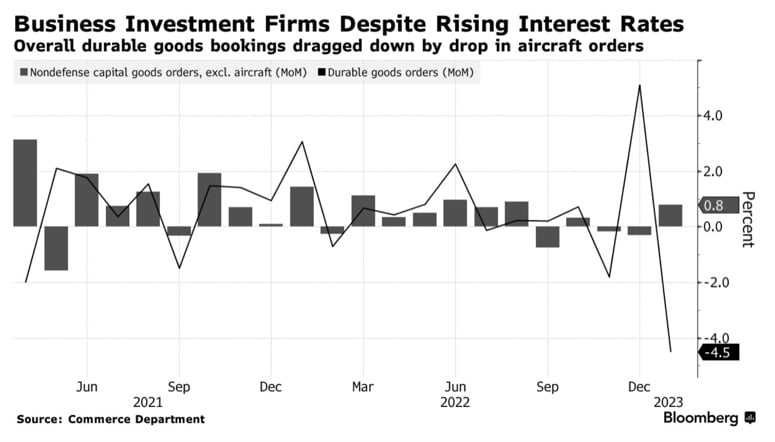

Below is a chart that explains in part the quandary in which investors find themselves:

Despite a very steep tightening of monetary conditions for more than one year now, the US economy does not seem to slowdown fast enough for the Fed to stop raising interest rates. The chart shows business investments increasing in January again (vertical bars), even if total investments dropped due to lower aircraft orders (a particularly volatile component of business investments overall).

In February, our median portfolio lost 2.18%. Over the same period, a portfolio consisting of 50% ACWI (All Country World Index) and 50% AGG (US Bond Aggregate) lost 3.00%. YTD, our median account is up 1.13% vs. 2.26% for our reference index.

Market developments

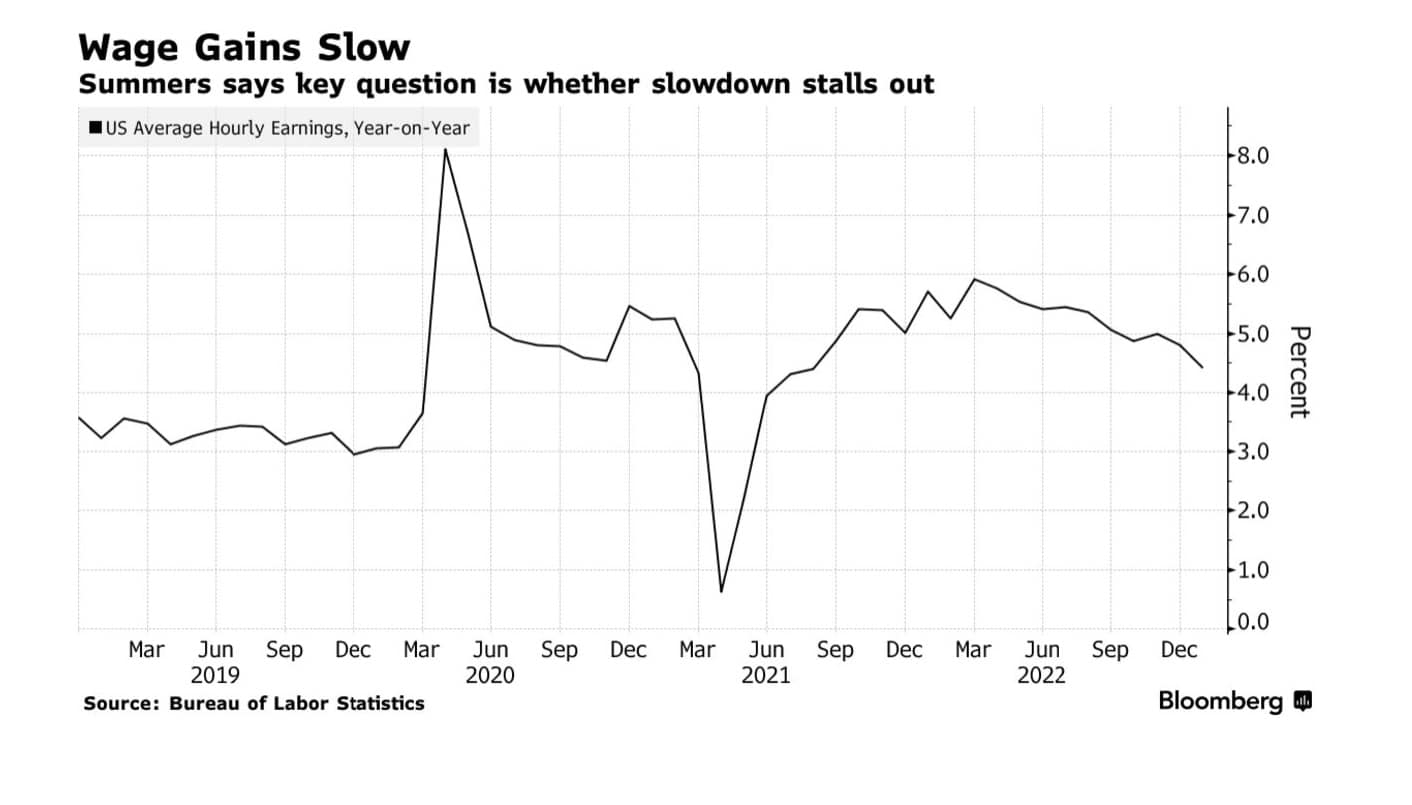

The month of February started with a piece of economic data that affected it for its duration. The unemployment data for the month of January, released on February 3, were much stronger than forecast. US payrolls increased 517,000 vs. an expected 180,000 and wage inflation, while on a downward trend, did not drop enough to calm investors’ anxieties about the likely Fed’s response (see chart below).

The fear for investors is that a stubbornly resilient US economy will force the Fed to continue its aggressive monetary policy for longer than anticipated.

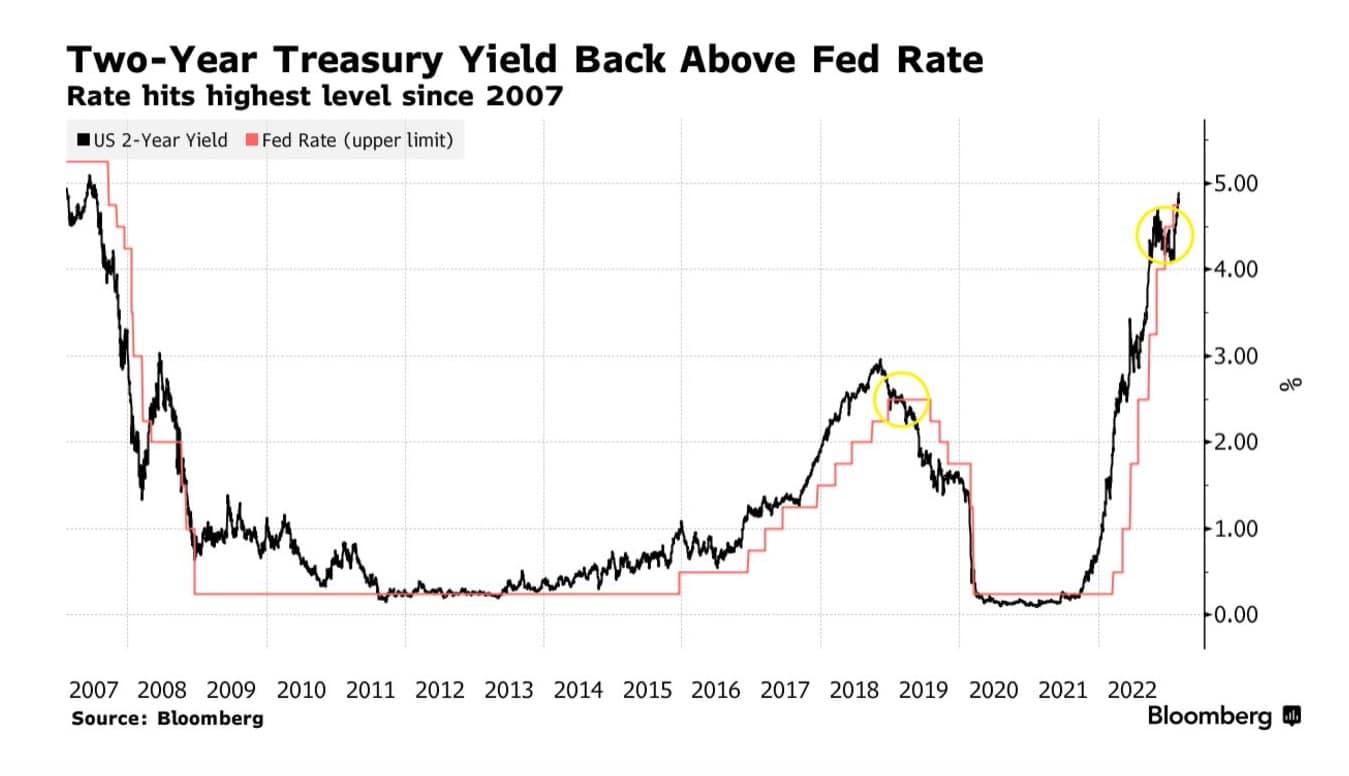

The chart below illustrates the unprecedented rise of interest rates in the US that results from this policy:

The yield on the two-year US Treasury has risen from barely above zero in late 2021 to close to five percent currently. The speed and size of the move upward has not been seen since the 1980’s. Its effect on the US economy is not yet fully measurable. So far, it has been muted and not caused even a mild recession. While this is good for all of us, it is not good for investors. Investors would like to see an end to the interest rate tightening cycle. That is not likely to happen until the Fed sees clear signs that its battle against inflation is won or almost won. We are unfortunately not there yet.

Tilts and Allocations

The market reversal in February did not surprise me given the extent of the uncertainty surrounding the Fed’s monetary policy.

I refrained from anything significant other than to increase moderately our non-US international exposure. Specifically, I bought IEFA, an ETF that tracks the performance of developed economies outside North America (Europe, Australia, Far East). This is on the belief that developed economies, outside the US, will continue to surprise to the upside and that the USD will not firm up.

Other than that, I continued to roll maturing US bills. With interest rates rising, a six-month US Treasury bill yields 5.13% (as of March 3).

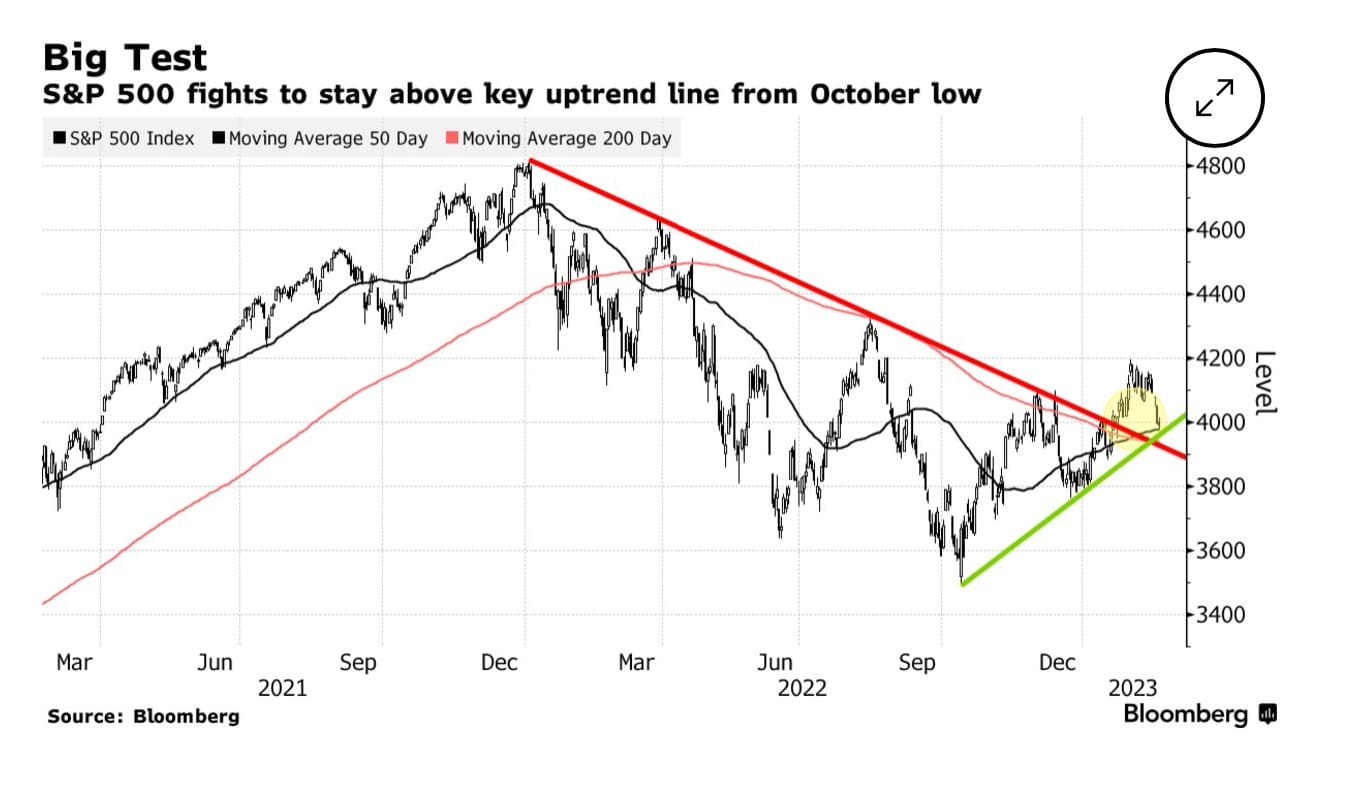

With interest rates relatively high, equities have now to compete with a mighty alternative: Risk-free US government bonds. This is unprecedented for markets participants. One would have to go back to the late 1980’s to find oneself in a somewhat equivalent environment.

In this context, it is not surprising that US equities are struggling, as illustrated in the chart below:

The next few weeks may show whether this uncertain pattern endures or not.

Conclusion

The next US employment data will be released on Friday March 10. Inflation data will follow on Tuesday March 14. On Wednesday March 15, the Fed will announce its next interest rate decision. The next few trading days could be volatile! While this is a perfect set of conditions for traders, it is not one for long-term investors.

I would advise investors to be particularly cautious over the coming week.

Please feel free to reach out to me with any questions. Thank you for your continued trust.

Jeff de Valdivia, CFA, CFP

Fleurus Investment Advisory, LLC

www.fleurus-ia.com

(203) 919-4980