Overview

In October, US indices largely recouped their September losses. A mixture of technical and fundamental factors underpinned this directional change. The S&Ps’ 500 rose 8.10%. All other US equity indices fared similarly. Noteworthy though is the relative underperformance of growth stocks with the Nasdaq Composite index rising only 3.94%.

Internationally, the EPAC BM Index of developed economies increased 5.14% but emerging markets dropped with the MSCI (EM) losing 3.10%. The resolutely strong USD contributed to these negative or lesser performances. So far, the USD Index (DXY) is up a whopping 18.09% in 2022. This is measured against a basket of currencies, including the €.

The bond market that had sunk last month together with equities, continued its slide down as the Federal Reserve (FED) persisted with their decisively anti-inflationary rhetoric. The long bond lost 5.55%. It has lost 32.80% this year. Interestingly, in a show of Investors’ renewed appetite for risk, the High Yield bond index rose 2.60%.

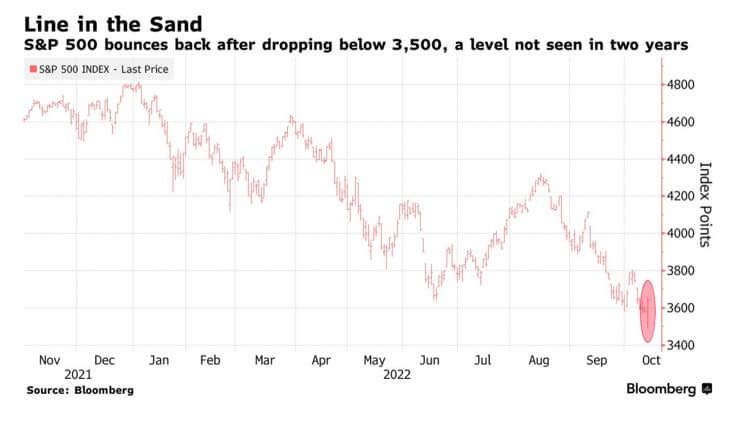

The chart below illustrates the technical bounce of the S&P’s 500 during the early days of October.

In October, our median portfolio gained 4.13%. Over the same period, a portfolio consisting of 50% ACWI (All Country World Index) and 50% AGG (US Bond Aggregate) rose 2.54%. On a YTD basis, our median portfolio has lost 19.50% vs. 18.25% for our index.

As a reminder, the equity allocation in our clients’ portfolios varies currently from 40% to 70%, depending on risk profile.

Market developments

Market volatility persisted in October, this time on the upside which is always better tolerated. Nevertheless, it points to the difficulty for market participants to gauge, with any degree of accuracy, the direction of the US economy.

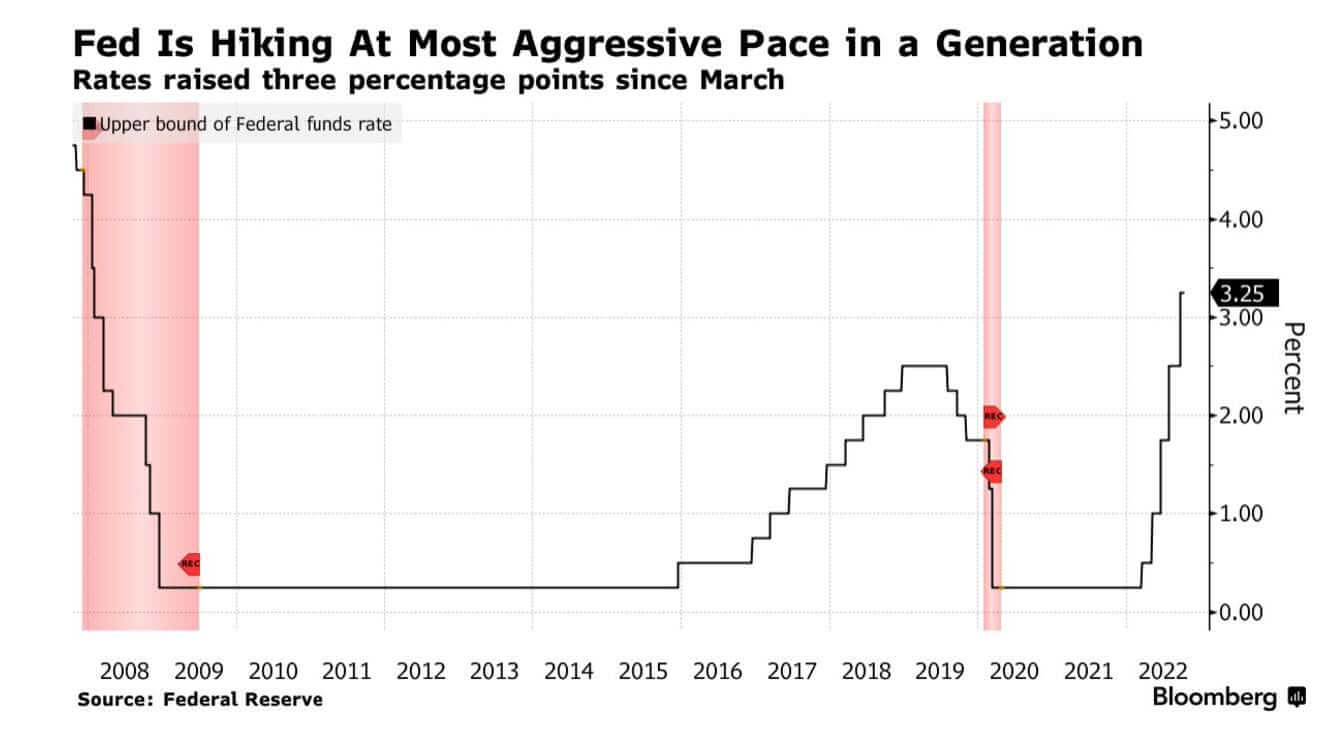

Fed policy remains extremely restrictive. As illustrated in the chart below.

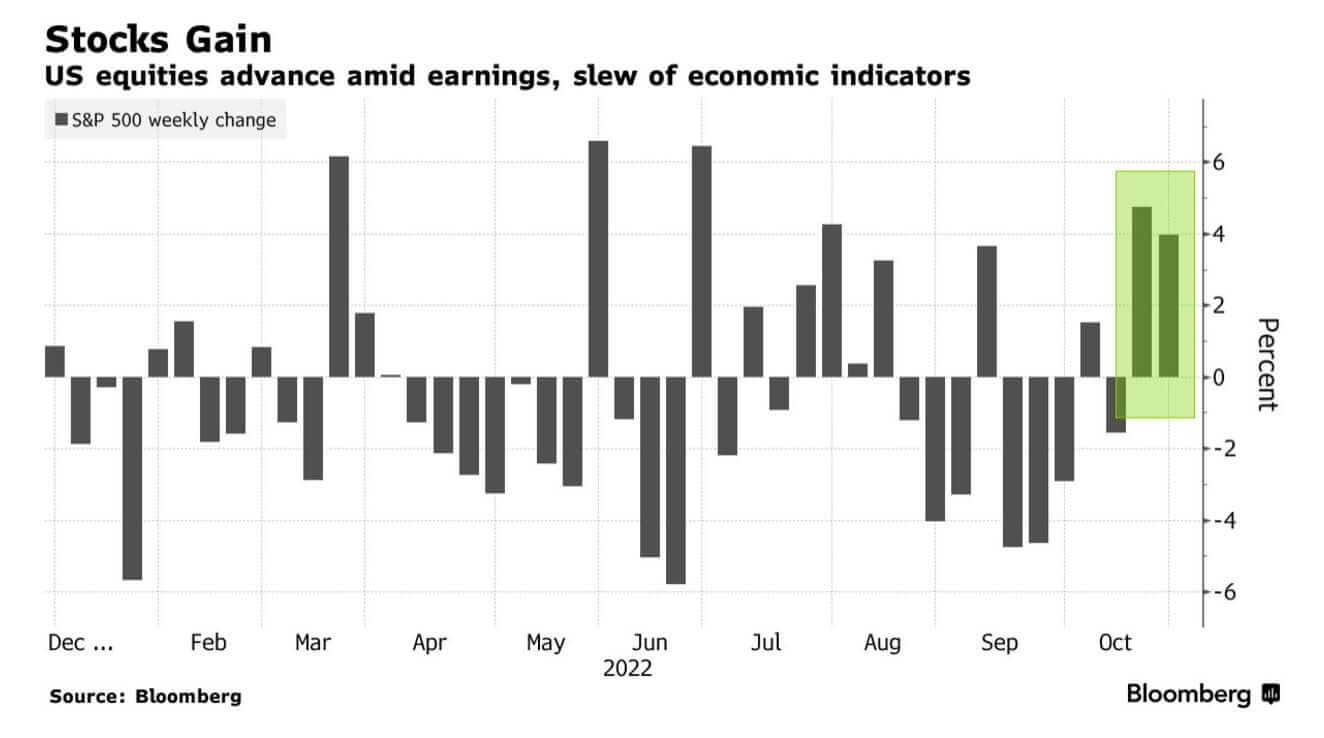

At the same time, the unemployment rate has not yet moved up significantly, the US consumer continues to support the economy as indicated by a relatively strong third quarter GDP number coming at 2.6% and third quarter corporate earnings have come in relatively positive, pushing equities up on a weekly basis in October, as illustrated below.

Meanwhile, inflation remains stubbornly high at around 6.65% on an annual basis (Core CPI, the preferred measure of inflation for the Fed). When taken as a whole, these data contribute to making the economic picture resolutely blurry, if not downright confusing.

Tilts and Allocations

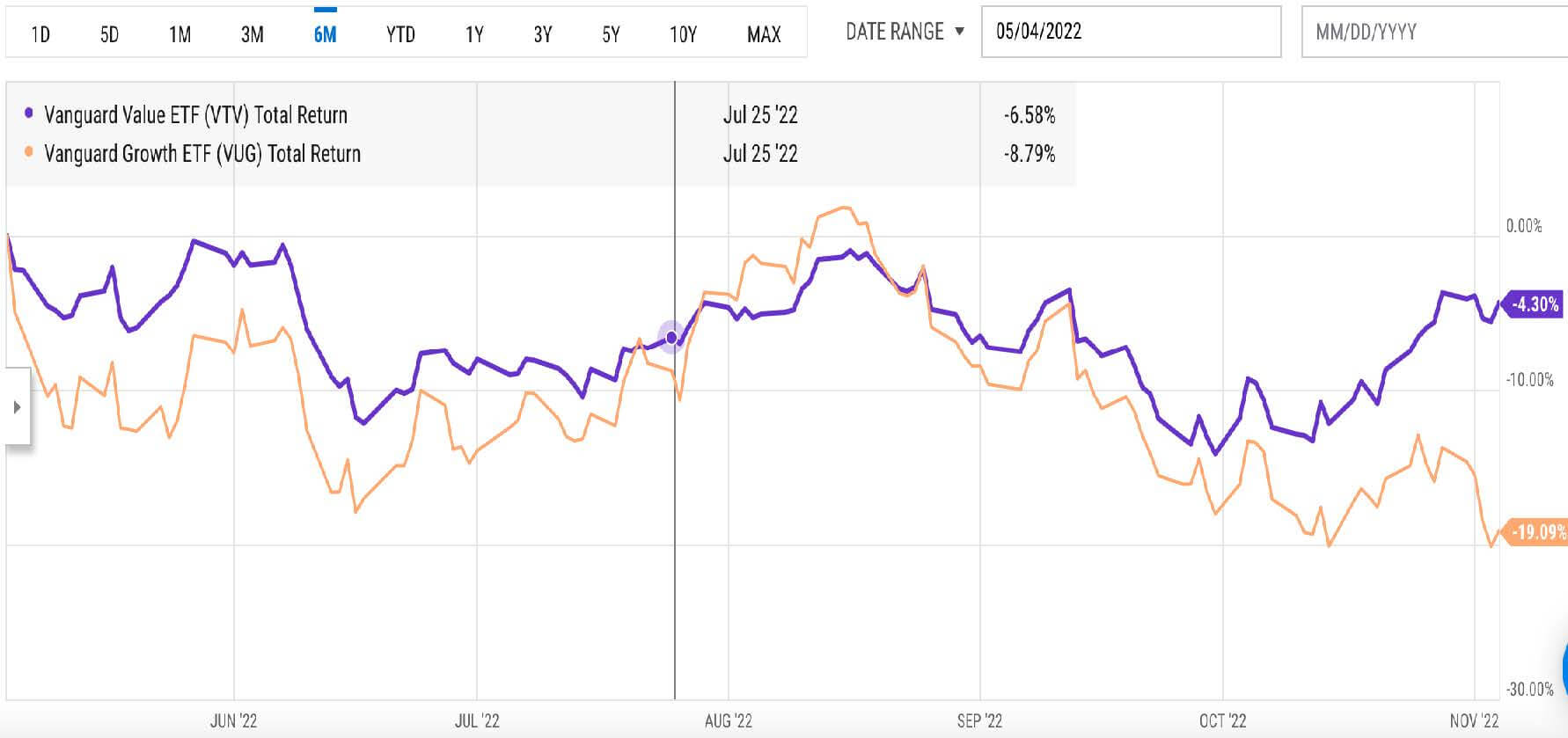

In October, I significantly reduced our investment in PRBLX, a mutual fund that, I have come to conclude, tracks the S&Ps’ 500. I did so to reduce our indirect exposure to growth equities. PRBLX has a 25% to 30% exposure to growth equities. I invested the proceeds in VTV, the Vanguard Value ETF (purple line in the chart below).

As illustrated below, the performance of growths stocks in 2022 (yellow line) has been dramatically worse than that of value stocks.

The vertical line marks the time when I started accumulating VTV and divesting from S&P’s 500 investments (SPY) or PRBLX. This switch of focus, within our equity allocation, has contributed meaningfully to our catching up with our benchmark recently.

In addition to our timely investment in VTV, our solid performance this past month resulted in part from the contribution from Air Liquide. The French industrial company posted above average results in the third quarter and jumped 7.5% in October. Thanks to a relatively stable USD this past month, we were able to benefit fully from this price appreciation. Looking ahead, I expect that the soonto-come robust monetary response of the ECB (European Central

Bank) to inflation in the EU will prevent a further erosion of the € vs. the USD. This will help our portfolios.

Elsewhere, I continued to buy three and six-months US Treasury Bills. With yields ranging from 3.50% to 4.60% and increasing throughout the month of October, these risk-free investments offer a great alternative to cash. Most of your portfolios are now invested accordingly.

Conclusion

“Upbeat company results, UK fiscal policy reversals and cheaper (equity) valuations at the beginning of October, buoyed risk assets this past month”. This quote from Bloomberg’s economists explains relatively well the market positive tone in October.

What could take it more sustainably higher are good inflation data. The next batch is coming next week. I keep on hoping that they will bring good news, finally and show that the Fed’s policy is starting to have a significant impact.

Otherwise, we will keep meandering in this very volatile and uncertain market environment, buffeted by economic news of a mixed or contradictory nature.

Please feel free to reach out to me with any questions.

Thank you for your continued trust.

Jeff de Valdivia, CFA, CFP

Fleurus Investment Advisory, LLC

www.fleurus-ia.com

(203) 919-4980