Overview

August was unequivocally unpleasant, performance-wise, for most investors. All major asset classes experienced declines, some of them particularly sharp ones.

The S&P’s 500 dropped 1.59%. The Nasdaq Composite declined 2.05%. Finally, the Russell 2000 (Small Cap Stocks.) cratered 5%. The general “risk-off” mood and the rising USD accelerated the correction in international markets. The EPAC BM Index of developed economies (ex-US) declined 4.16% and the MSCI EM (Emerging markets) lost 6.13%.

It is hard to pinpoint one event or cause for this August downdraft. However, the persistent malaise in the bond market caused by the relentless tightening of monetary conditions by the Federal Reserve (FED), combined to the downgrade of US government debt by Fitch, a credit rating agency, in the first week of the month, could not have helped. A general “risk-off” mood followed that caused investors to sell across most asset classes.

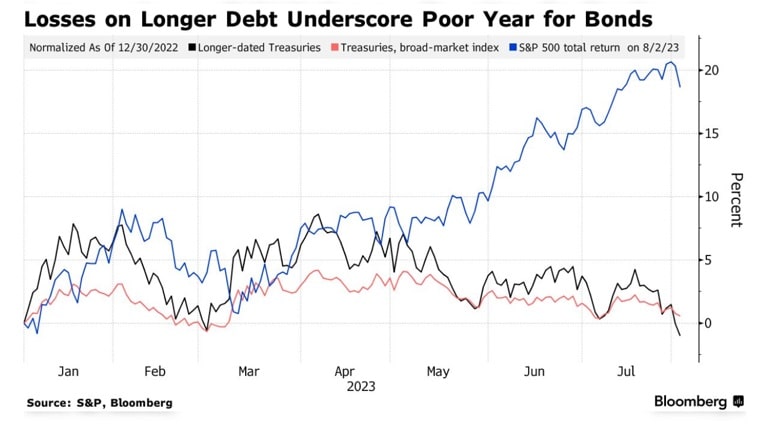

The graph below shows where we stood at the end of July, particularly with respect to the US bond market:

In this difficult environment, US bond yields rose. The US bond aggregate index dropped .64% while corporate bonds declined .78%. The US long bond declined a more painful 2.79%.

In August, our median portfolio declined 1.93%. Over the same period, a portfolio consisting of 50% ACWI (All Country World Index) and 50% AGG (US Bond Aggregate) lost 1.77%. YTD, our median account is up 8.06% vs. 8.23% for our reference index.

Market developments

Fitch downgraded US government debt on August 2 to AA+ from AAA. While this was not unexpected, the timing of the downgrade surprised investors. Why now? The US economy is maintaining positive momentum in an adverse monetary environment with the FED pushing interest rates up forcefully over the past eighteen months. Does Fitch know something we do not or was this just poor timing? I do not know, but when that happens during a month when liquidity is severely diminished by reduced presence on trading desks and when investors are often vacationing, price swings are all that much amplified.

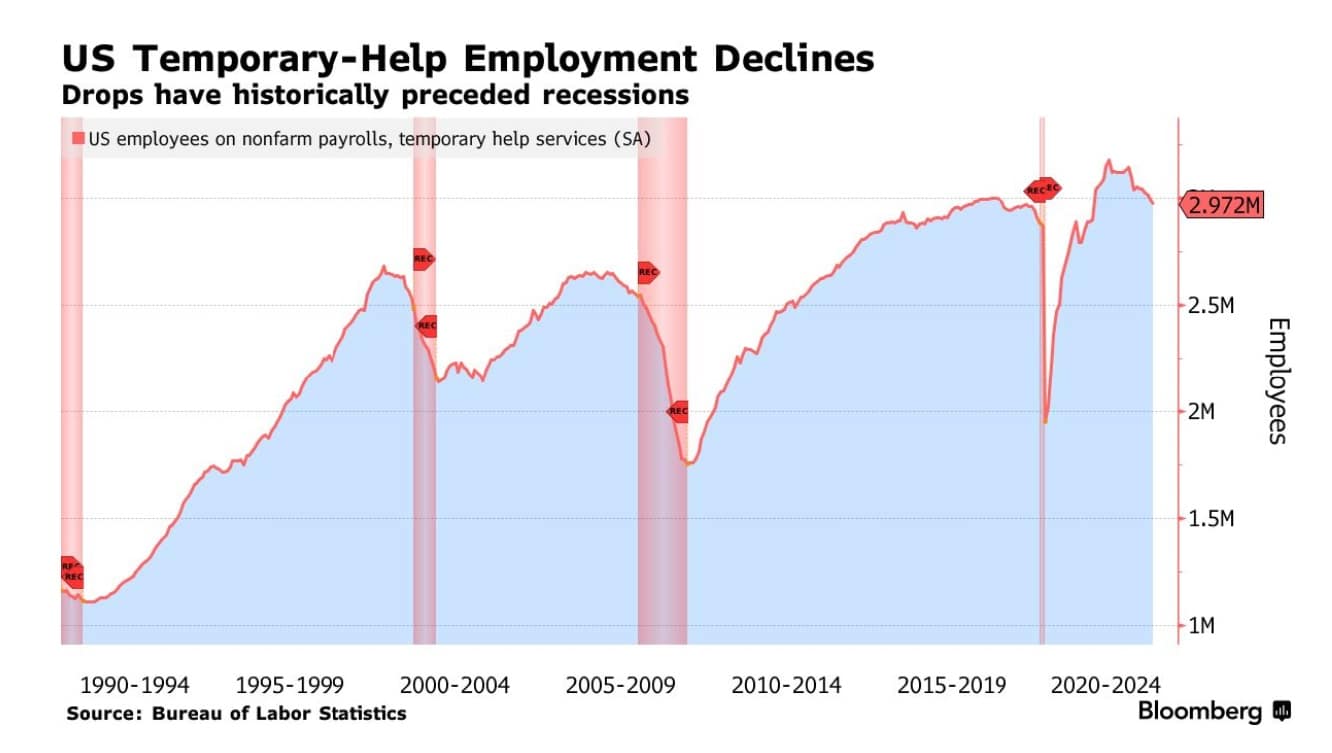

If we exclude the credit downgrade event, the news this past month were relatively benign. Employment is finally showing signs of moderation, as shown below:

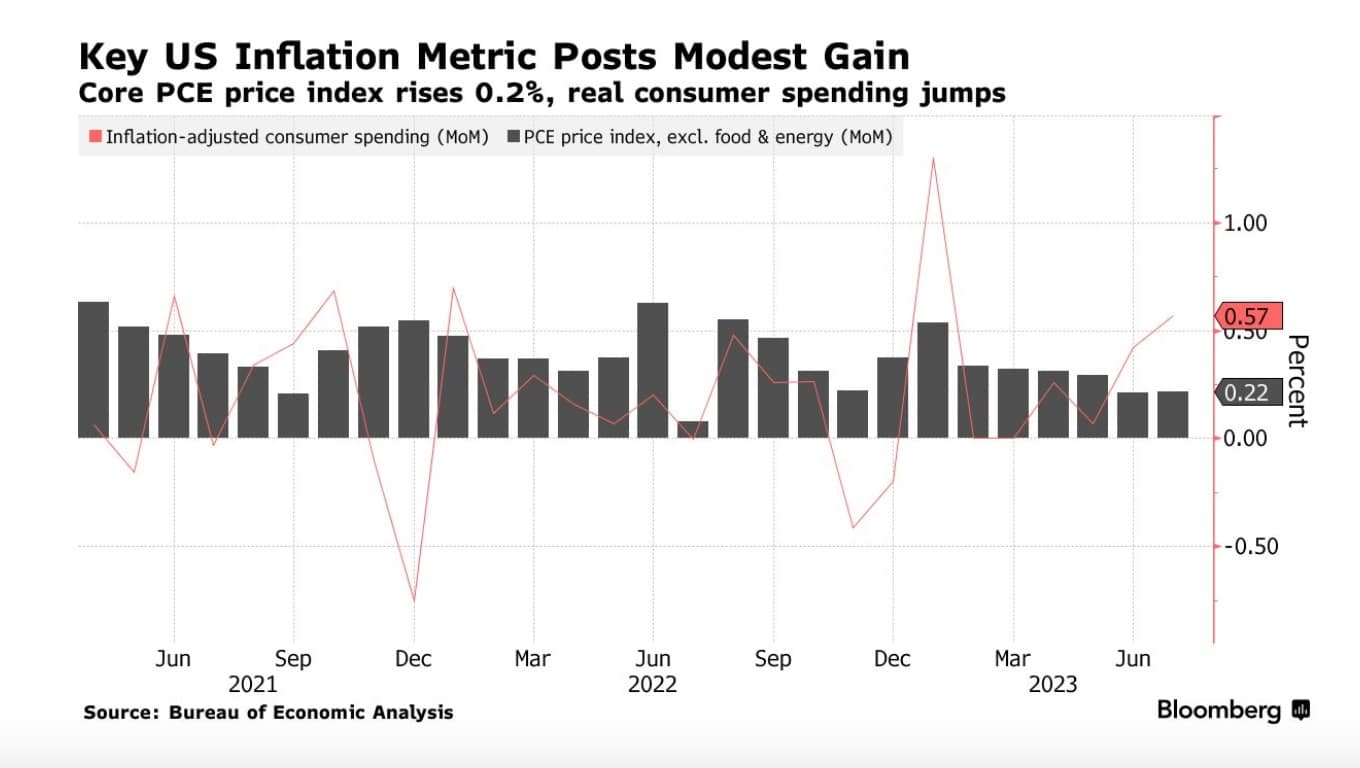

As for inflation, the latest releases confirmed the moderation of the past three months:

With that, some think that the US economy may be on its way to a “soft landing”. This would be a welcome and unexpected outcome when considering the unprecedented speed and intensity of interest rate increases since early 2022.

Tilts and Allocations

We owe our slight underperformance this month to the 10% decline in Charles Schwab shares over that period. On August 15, Schwab announced that their asset gathering efforts were slowed down by attrition in some part of the TD Ameritrade franchise that they are in the process of integrating. The market did not like to hear about it and punished the stock. It has since recovered partially.

Because I think that SCHW is a stock that is going to increase in value quite substantially over the next twelve months, I could have added to our position. I decided against it for two reasons: 1) we initiated the position at a lower level and are, even at current prices, in positive territory, 2) most accounts already have a 5% allocation (or more) and I do not like to increase allocation to single, undiversified investments, beyond that mark.

Here is the graph of SCHW’s price year-to-date. The vertical bar marks the timing of our initial investment:

Elsewhere in our portfolio, Air Liquide was the only investment showing a positive August return, clocking .57% in spite of a declined € vs. the USD (down 1.5%). All our other investment performed in line with expectations, given the negative environment.

This past month, except for the episodic rolling of maturing US treasury bills, I refrained from activity on most accounts. .

Conclusion

The current economic environment is novel. On the one hand, the severe monetary restrictions induced by the FED should cause the US economy to fall into a recession. On the other, it has not done so yet against all odds and previous experiences.

Perhaps the COVID years and the unprecedented stimulative measures taken by the US government and other nations have disrupted the dynamics of our economies in such a way that the laws of economics have been suspended.

Yet, it is hard to think that a push from a zero interest rate environment to a five percent one, in the space of eighteen months, is not going to do some damage. I remain hopeful that, if economic damage ensues, it will be minimal.

Thank you for your continued trust.

Jeff de Valdivia, CFA, CFP

Fleurus Investment Advisory, LLC

www.fleurus-ia.com

(203) 919-4980