Overview

October was the third consecutive month of losses across equity and bond markets. The pain has been acute, even if, as of this writing, both markets appear to have bounced off their lows.

The S&P’s 500 lost 2.10% in October. The Nasdaq Composite declined 2.76%. Finally, the Russell 2000 (Small Cap Stocks.) dropped 5.0%. In international markets, the EPAC BM Index of developed economies (ex-US) shed 4.56% and the MSCI EM (Emerging markets) lost 3.95%.

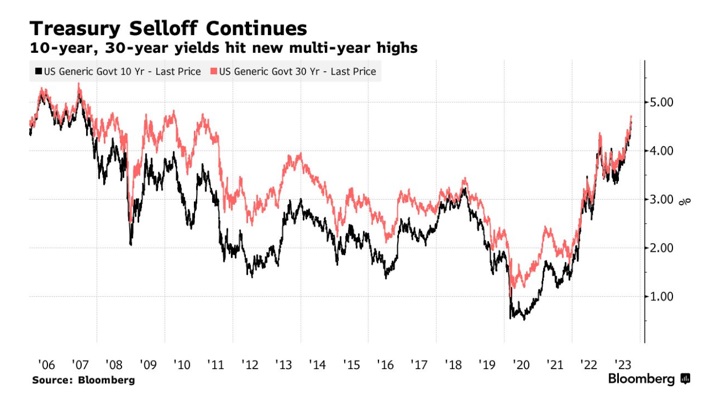

Deteriorating bond market dynamics and better than expected economic data combined to give investors reasons to sell. In the fixed income sector, US bond yields rose sharply.

As can be seen in the graph below, the fast clip at which interest rates have risen in 2023 accelerated further in early October:

Bond portfolios lost value. The US bond aggregate index dropped 1.58%. Corporate bonds declined 1.87% and the US long bond declined 4.93%.

In October, our median portfolio declined 1.60%. Over the same period, a portfolio consisting of 50% ACWI (All Country World Index) and 50% AGG (US Bond Aggregate) lost 2.06%. as of October 31, 2023, our median account was up 2.50% in 2023 vs. 2.28% for our benchmark.

Market developments

The month started with lots of selling in the bond market. It is hard to pinpoint a particular reason for it. Bond specialists are now speaking of a technical issue having to do with the timing of the US Treasury refinancing program. That technicality would have caused the spike in 10 year and longer-term bond yields. I do not know whether to give much credence to this or not. Others are pointing at the high debt incurred at the federal level to combat the effects of Covid in 2020 and 2021. That high level of debt seems to have become a cause for concern. This abruptly recovered sense of fiscal discipline would explain the sharp spike in long term yields in October. I am not convinced. After all, this has been a known fact for some time now.

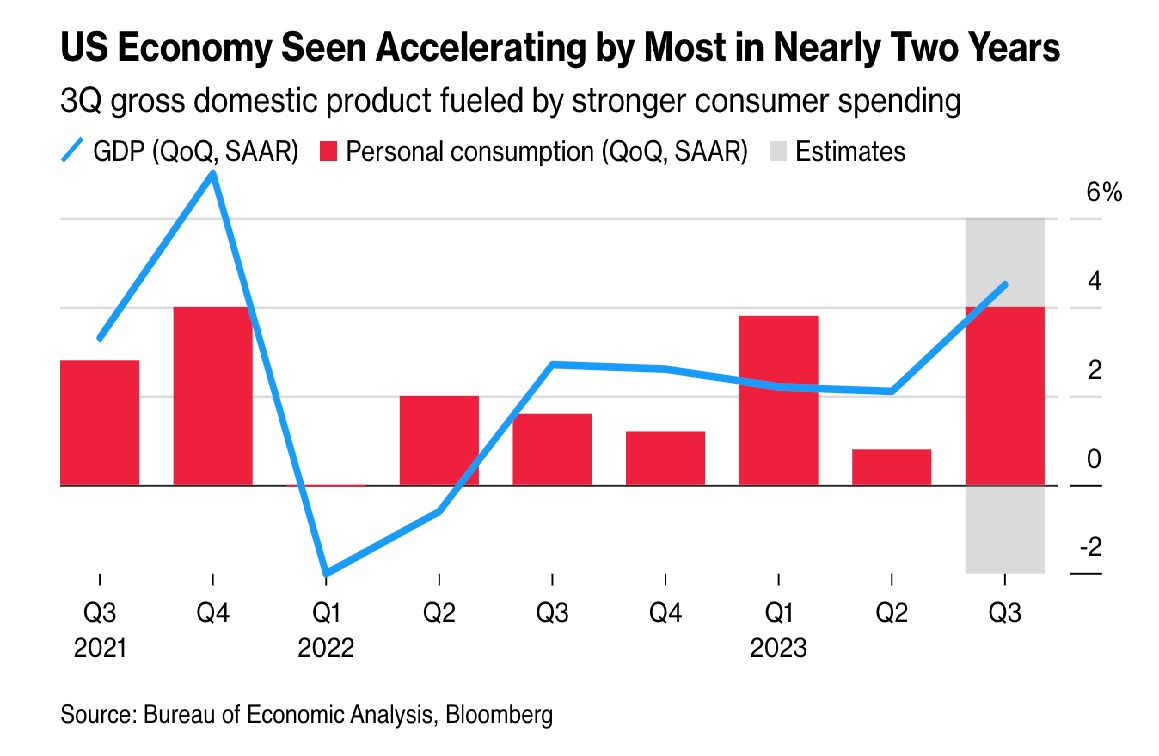

What we know is that the economic data released in October pointed at a resilient and somewhat unexpectedly robust US economy. In a twisted way, good (economic) news, became bad (market) news. The employment numbers for September were particularly strong (336,000 new jobs created) and well above expectations. Similarly, the third quarter GDP data was spectacular, as shown in the graph below.

In combination, the good health of the US consumer and that of the US economy caused equity markets to decline sharply in October before recovering somewhat in the last trading sessions on the back of reasonably good corporate earnings releases.

Portfolio Commentary

In October our average portfolio performed better than its benchmark, in part due to Air Liquide (AIQUF). In a negative market environment, AIQUF managed to rise 1.25%, in spite of a declining €.

Also helpful was our small investment in GBTC (Bitcoin Trust). GBTC rose close to 40% in October. The sharp increase was due to the growing likelihood that the SEC will permit the creation of a Bitcoin cash ETF. If and when that happens, GBTC should be a prime beneficiary. For those clients that have remained invested in GBTC, such a spectacular progression was helpful even when the investment itself did not account for more than 1% of total portfolio value.

Elsewhere in our portfolio, my activity was limited to account maintenance for the most part. I remained cautious and did not move often in this fast and volatile market environment. On a few occasions, as US Treasury bills were maturing, I reinvested part of the proceeds in AGG (US bond aggregate ETF). I did so on the assumption that the bond market rout was overdone. So far, this small move has proven beneficial.

As a parting comment, below is a chart of the S&Ps’ 500 just before the bounce of the end of October and the spectacular recovery of the past week.

For technicians, bouncing up from the 4200 level was a possibility. Indeed, it proved a reality. As of this writing the S&P’s 500 is at 4380. It i s up 4.29% since October 28. While market technicians will tell you otherwise, these reversals are extremely hard to predict if very easy to explain in hindsight. Missing a reversal of this magnitude may mean underperforming for a year or two. We did not miss it.

This is yet another reason to remain invested when managing for the long term and to stay healthily skeptical of the view expressed by most market pundits.

Conclusion

The Federal Reserve (Fed) has signaled that it was ready to stop hiking interest rates and, at the same time, that it remained committed to defeating inflation. For now, this means that it will be “data-dependent”. The Fed could be done with its tightening cycle. Or not…

At this juncture, further action on interest rates will depend on the economic news that emerge over the coming weeks. The Fed will be particularly attentive to any sign that confirms the current softening trends in wage growth, total employment, and inflation. As long as those trends prevail, the likelihood of an additional rate increase diminishes.That, in turn, should make life a little easier for equity investors.

Thank you for your continued trust.

Jeff de Valdivia, CFA, CFP

Fleurus Investment Advisory, LLC

www.fleurus-ia.com

(203) 919-4980